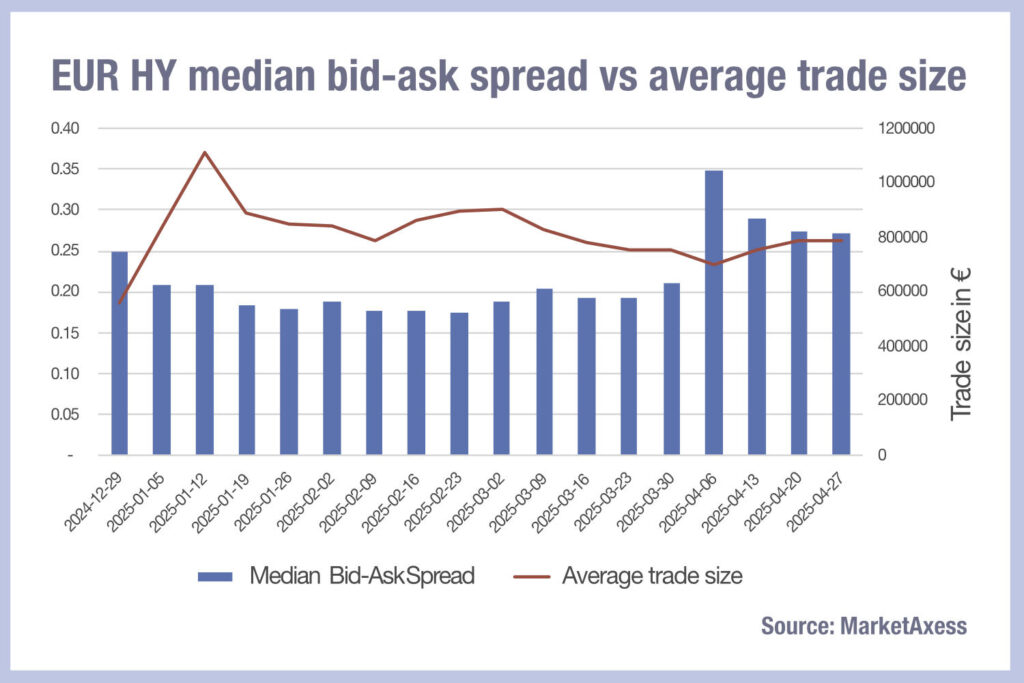

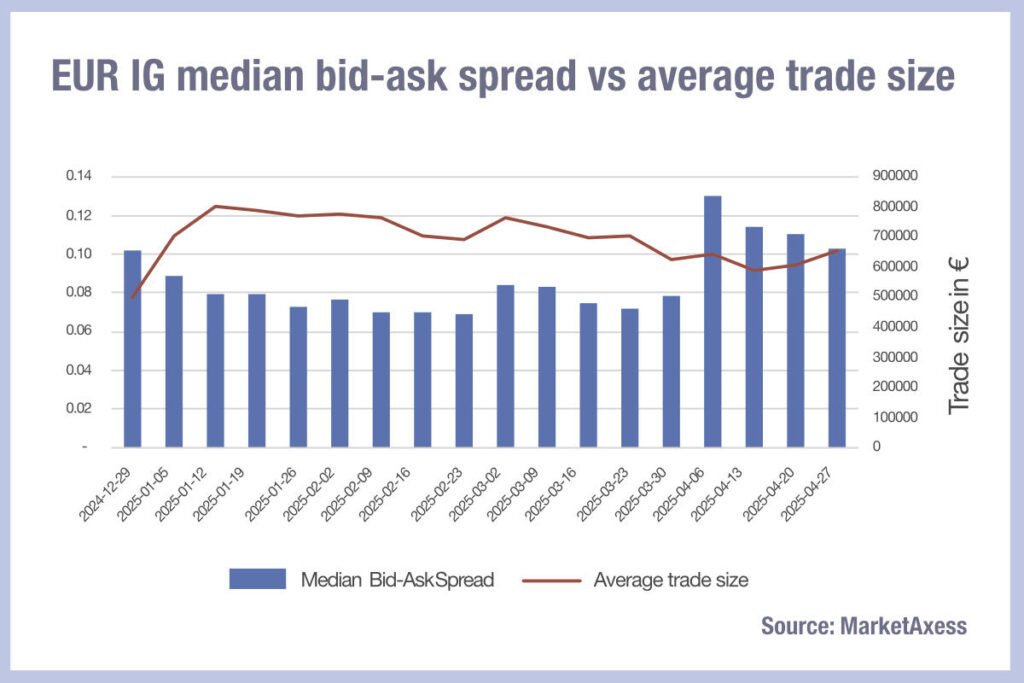

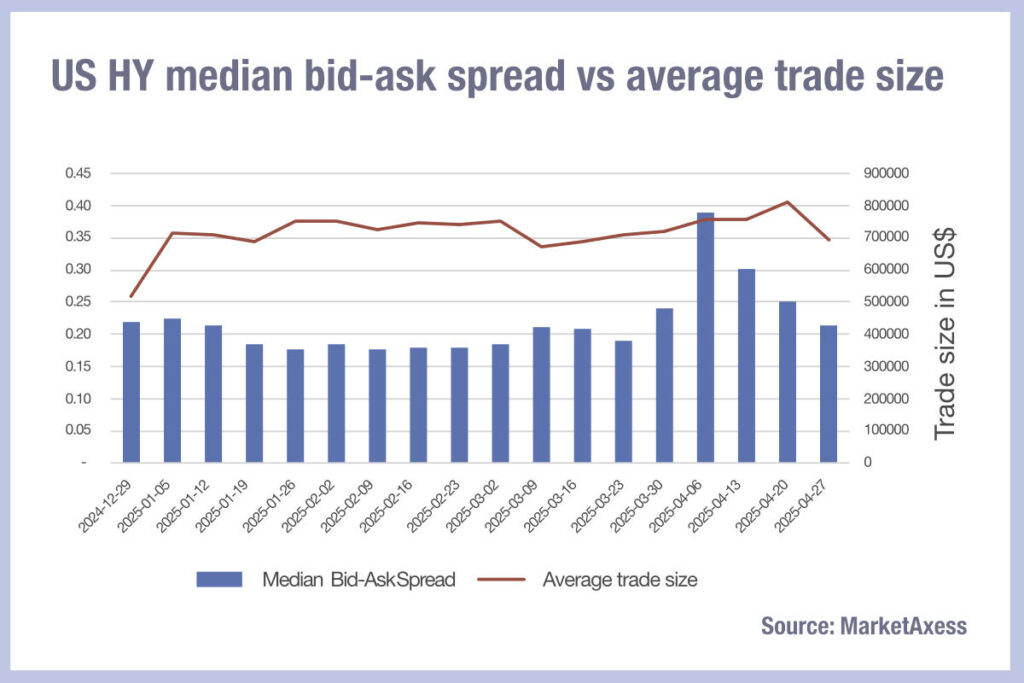

Liquidity costs in European corporate bond trading remain elevated, after the tariff shock in early April saw bid-ask spreads widen significantly across markets, according to MarketAxess’s CP+ data.

European high yield (HY) markets increasing to 60% their average size year-to-date (YTD) in the first week of April, and last week were down, but still at 25% higher than their average size YTD.

European investment grade (IG) credit bid-ask spreads are now up 10% on their YTD average having hit 59% over the YTD average in the first week of April.

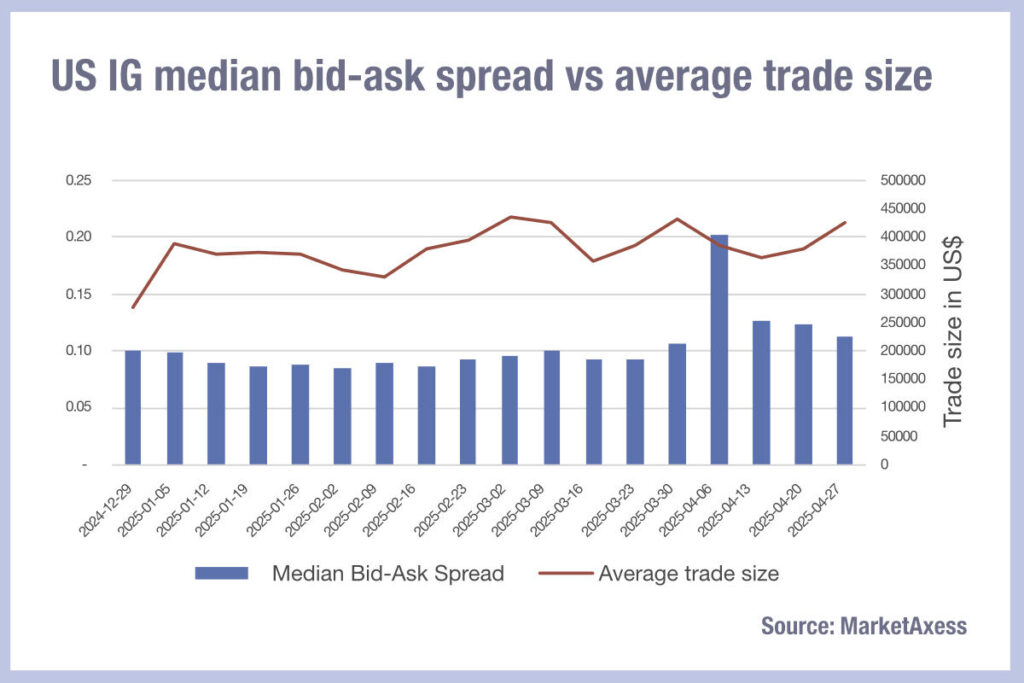

By contrast the US market has seen a far more rapid decline in bid-ask spread sizes in April. Both saw average trade sizes drop at the start of April and then gradually increase, correlating with the move in spreads. US IG and HY saw a 102% and 85% expansion on the YTD average in the first week of April, but have since reached 10% and -2% of the year to data average by the end of April.

This substantial fall in the cost of liquidity in the US market, not mirrored by European bonds, may well reflect a difference in credit concerns for Europe, or the capacity of brokers to deliver better pricing at lower costs than the European market.

In US credit markets, average trade sizes had slowly increased over the year since February, where European markets had seen a gradual decline. Following the April turbulence, most markets saw average trade sizes rise again, US HY saw average trade sizes fall, according to MarketAxess TraX data, which assesses trading across multiple markets. Given the -2% fall in average bid-ask spreads relative to the YTD period, US HY seems an outlier.

Seeing these very nuanced perspectives, it emphasises the need for traders to have accurate pre-trade data when engaging with turbulent markets, to understand the risks of market impact and an understanding of the size of trades that can be executed effectively.

©Markets Media Europe 2025