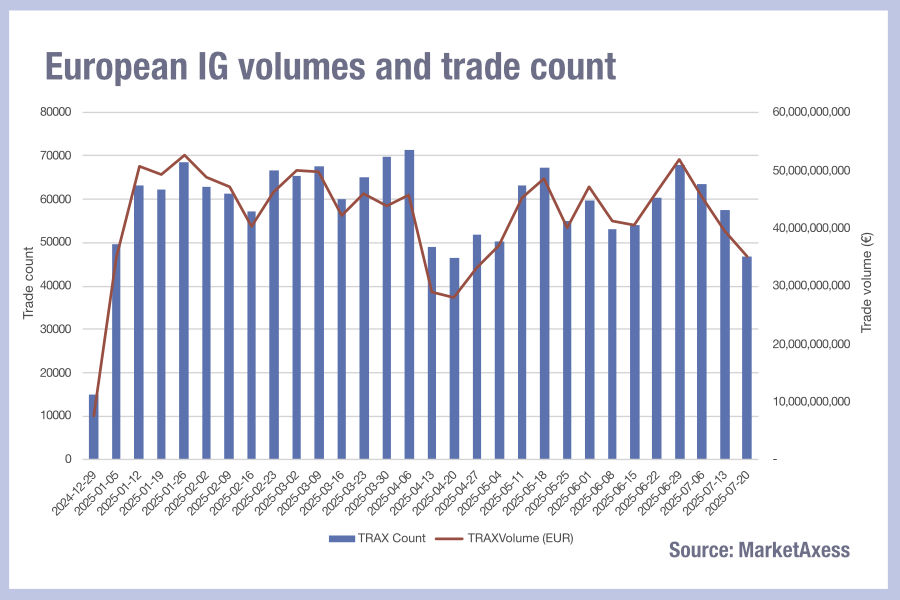

European corporate bond markets have seen trading volumes and trade count collapse going into summer, as the holiday period provides some respite for tired trading desks, according to MarketAxess data from its TraX service, which reports activity across multiple markets.

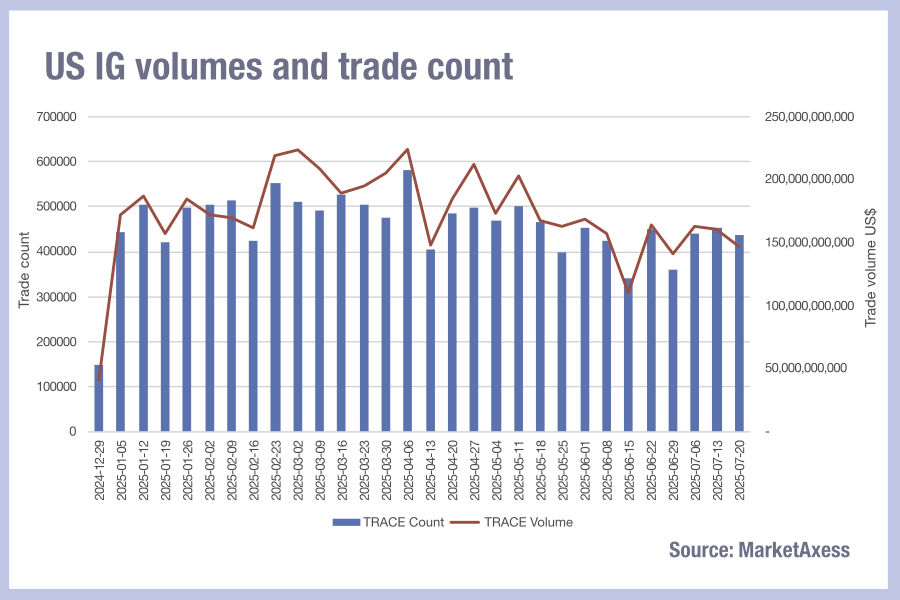

However, US credit markets are not showing the same decline, despite a slight decrease in activity.

Average bid-ask spreads, as captured by MarketAxess’s CP+ pricing tool, indicate that the costs of liquidity are tracking a stable pattern of tightening since the beginning of Q2. From the end of May, investment grade (IG) bid-ask spreads in the US markets remained in the 0.09-0.1 price as a % of par, and 0.08-0.09 price as a % of par range for European IG.

For high yield (HY) traders, a wider range of liquidity costs have been seen across the same period, with US HY swinging between 0.15-0.19 price as a % of par, and European HY between 0.2-0.24 price as a % of par.

This broadly indicates that the summer period may see a dip in liquidity availability for European traders, but limited or no increases in costs for trading, while the US maintains a gradually improving liquidity picture based on flat-to-falling liquidity costs and consistent volumes.

©Markets Media Europe 2025