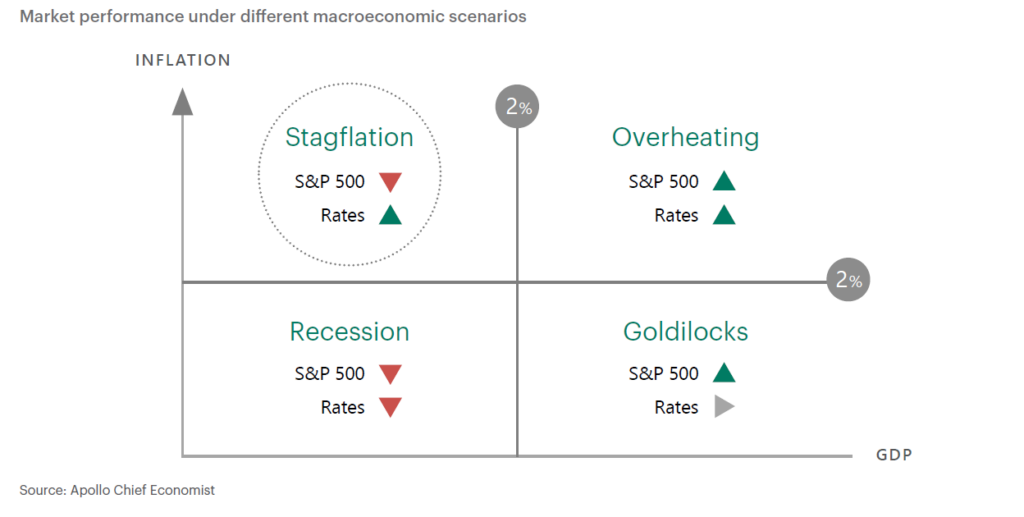

Torsten Sløk, Apollo Global Management’s chief economist, has outlined four key scenarios that investors need to consider potential outcomes of the current trade war and inflationary situation.

“Goldilocks is a straightforward economic scenario,” he writes. “In this environment, risky assets, including the stock market, tend to do well because neither inflation nor interest rates are a problem. This is actually quite easy as an investor—just buy risky assets. In particular, the stock market will likely do well because you have high GDP and low inflation, and business is good.”

Overheating is also quite straightforward, he notes, as the S&P 500 goes up, but rates are held higher for longer.

“An overheating GDP means high inflation,” he says. “Higher rates bite on companies that have weak credit fundamentals, in particular those with low coverage ratios. If you’re low in quality, you run the risk that companies will struggle if interest rates are higher for longer.”

He says that investor opportunities in this scenario are largely in investment grade credit, first-lien senior-secured, at the top of the capital structure.

In a recessionary scenario he suggests investors could just buy long-term government bonds as rates will decline.

However, he warns that currently the market is facing stagflation, with earnings going down and interest rates going up.

“We are quite worried about the overall economic outlook,” he writes. “But that does not mean we should be sitting on our hands. There are a number of things that we can do in the stagflation quadrant.”

The first is to watch quality as investment grade credit may provide opportunities, along with high quality public or private equity.

“Second, considering dislocation funds, especially secondary funds, because speculation tends to be associated with volatility,” he says. “In a time of stagflation, it’s possible to buy distressed credit away from where it would normally be trading. In that scenario, you will often have distressed sellers as well. There tends to be a lot of private equity assets in secondary markets, with sellers selling not because they have a different view of the economic outlook, but because they’re forced to do so.”

Finally he notes to find themes that are distanced from the trade war.

“Those include infrastructure, data centres, climate, and energy transition. While mostly far away from the trade war, these sectors may nevertheless offer interesting entry points simply because of the turbulence in the market,” he writes.

©Markets Media Europe 2025