Research by Aviva Investors has broken down the illiquidity premia paid via private debt markets, noting that it is improving for investors, even as corporate borrowers with higher-rated debt begin to tap the market.

“While it is too early to predict the full impact of tariffs and economic uncertainty on public corporate spreads throughout 2025, we anticipate more short-term opportunities in private corporate debt and structured finance,” write David Hedalen, head of private markets research and Nick Fisher, director of research for private markets at Aviva Investors. “These private debt sectors typically reprice to public markets the fastest and have the shortest completion times, particularly when there is a distressed seller or an urgent need for capital.”

Illiquidity premia create a relative value difference between private and public debt, where public debt can more easily be traded on due to its more standardised nature.

“For investors who can provide long-term patient capital, these premia represent the potential to harvest additional returns from investing in private debt, while also enabling investors with a ‘multi-sector’ or opportunistic approach to take advantage of relative-value opportunities between private debt sectors and pricing dislocations versus public markets,” they write.

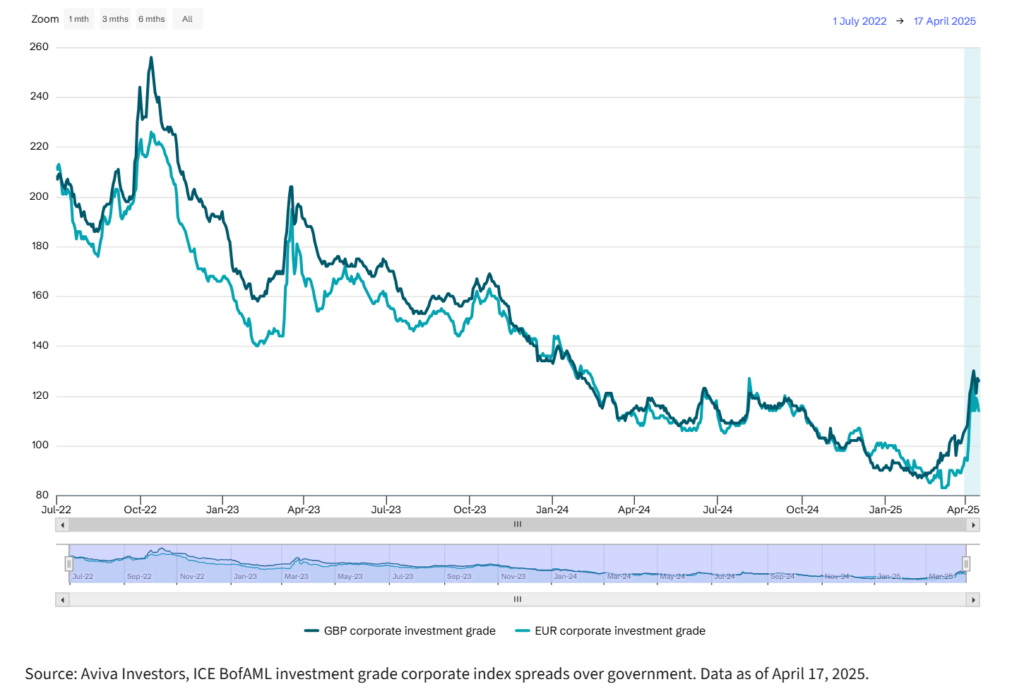

Corporate spreads have widened over the past three weeks, after hitting all-time lows according the Aviva team, which they observe present ‘attractive entry points’ for investors. Of the different private debt categories, these tend to re-price the fastest relative to public debt markets they note.

Interestingly, they also found that borrowers rated as investment grade (IG) are tapping into the private debt markets, an area which has largely been the preserve of lower rated credit historically, despite the widening credit spreads and unchanging rates outlook.

“Regarding credit risk, we believe IG markets offer favourable entry points. However, it’s crucial to maintain discipline in sub-IG sectors and focus on strong defensive sectors like consumer staples and healthcare,” they note.

More broadly, since 2022 the average illiquidity premia across all private debt sectors have improved, as public debt spreads tightened but public debt spreads did not.

©Markets Media Europe 2025