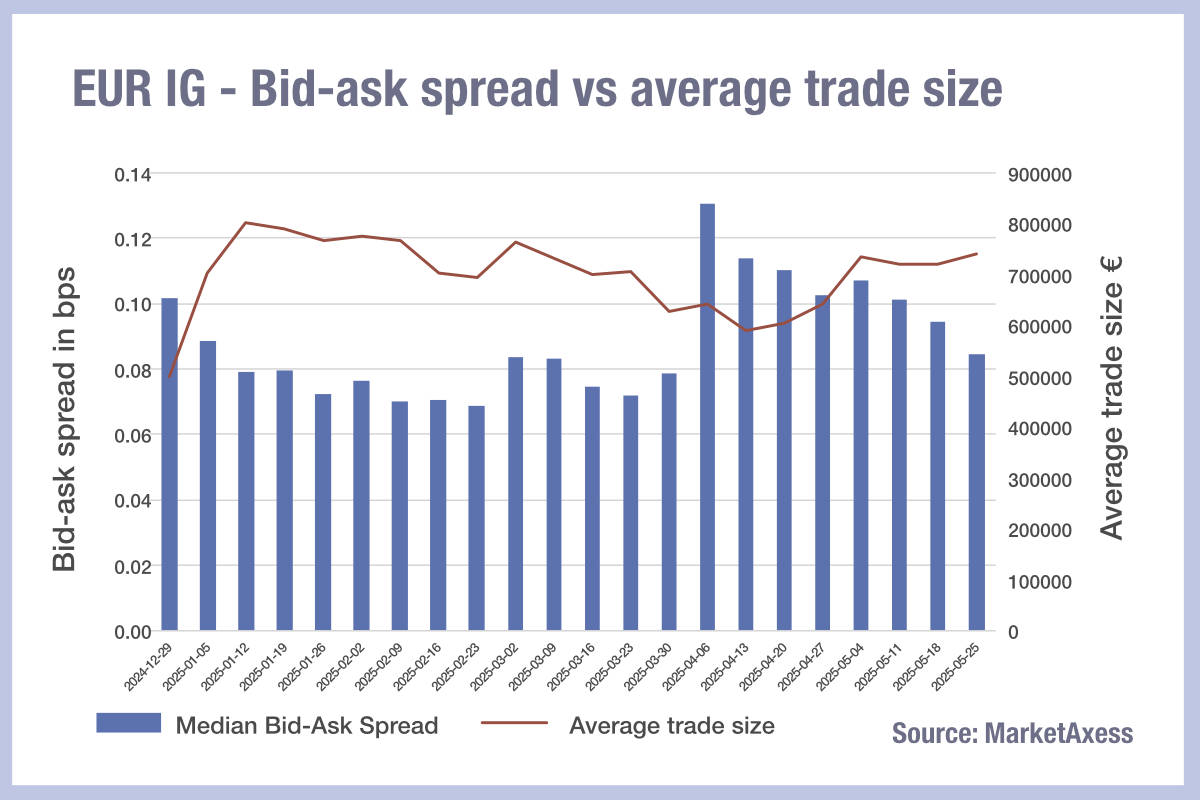

The careful return to pre-trade-war bid-ask spread levels continues in European credit markets, according to data from MarketAxess TraX, which assesses trading across multiple markets.

In European investment grade (IG) median bid-ask spreads also blew out in that same week, and have declined more dramatically since. Bid-ask spreads last week were down 4% on the YTD average.

Trade sizes dropped as a result of the trade war, but have recovered since, to reach 5% higher than YTD average last week.

Larger trades with a smaller cost of liquidity is net positive as this suggests the price of larger trades is falling. Trade count is down 12% and trade volume is down 8%, so the ability to trade larger sizes does not reflect increased market activity, but genuinely lower cost liquidity.

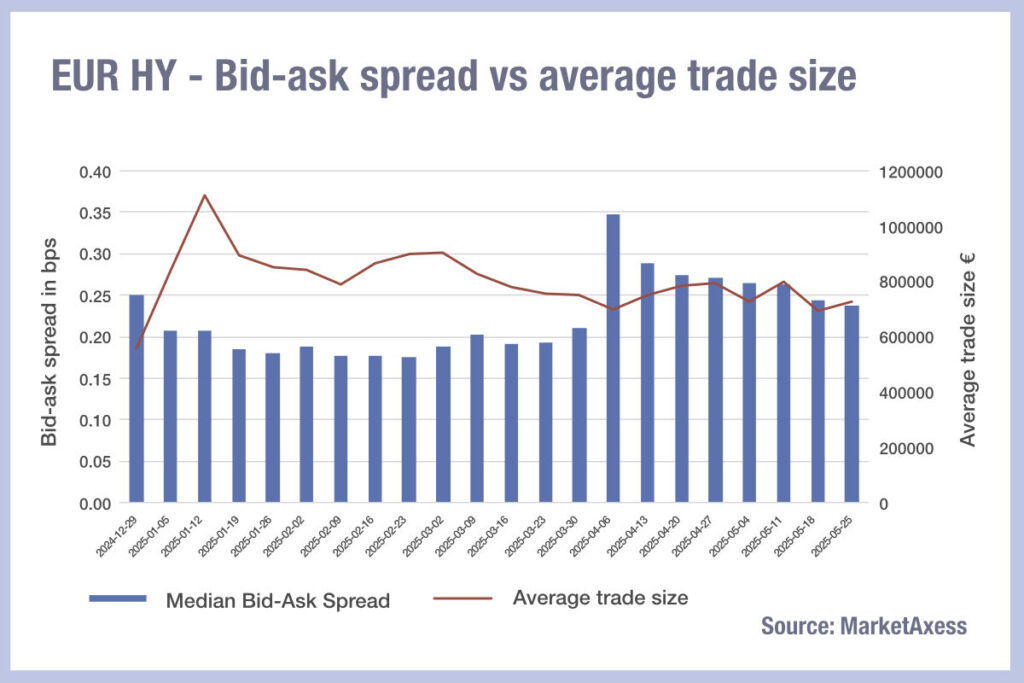

In high yield (HY) markets, trade sizes were down 9% last week on the average for the year having plateaued in April, when markets first climbed aboard the ‘Liberation Day’ rollercoaster.

Bid-ask spreads have been tightening after blowing out on week of 6 April, but last week were up 6% on the year-to-date average. With trade counts down 10% and trade volume down 19% on the year-to-date (YTD) average, the decline in average trade sizes suggests less risk is being traded leading to a smaller overall liquidity pool, despite lower liquidity costs.

Given the worsening credit conditions created by a volatile market, this split between the higher grade and lower grade debt is likely to persist.

©Markets Media Europe 2025