The buy side must be an active participant in shaping market structure if investors are to achieve the best returns, says Cathy Gibson.

The buy side must be an active participant in shaping market structure if investors are to achieve the best returns, says Cathy Gibson.

Biography: Cathy Gibson is head of dealing at Royal London Asset Management, having joined the firm in February 2018. Prior to that she was head of fixed income trading at Deutsche Asset Management (now DWS) and senior fixed income trader at Pioneer Investments (now Amundi Pioneer), having started her career at Bank of Ireland Asset Management, after studying economics at University college Dublin.

We’re seeing an increased use of internalisation by buy-side firms, how does it compare to the other range of execution options that you have?

Under MiFID II, if we internally cross the trades between one fund and another fund with a change in beneficial owner, we would have to register as an organised trading facility (OTF), so we cross trades externally. The benefit of crossing when you get further down the liquidity scale is huge, because the bid-offer spreads can be up to 1 point or 1½ points in the bonds.

We have been looking at a number of different venues and chosen a preferred counterparty for our crossing business. We do cross a significant amount, and that’s because some of the type of assets we have can be in illiquid sterling, we do everything from investment grade (IG), high yield (HY), asset-backed security (ABS) loans to the more illiquid investments.

What’s the proportion of trading you run electronically versus voice, for credit and rates?

We trade a relatively large amount through voice and that’s the nature of our business in terms of the illiquidity of some of the asset types that we are handling. Equity is exclusively electronic, fixed income is split. Our rates business would be 95 plus per cent electronic. The credit spectrum is about 30 to 40 per cent electronic only, depending on whether you count process trades as electronic or not.

To what extent do trading platforms support your needs at the moment?

From an execution point of view and from a liquidity perspective, they have done a reasonable job. With issues such as creating greater price transparency post-MiFID II, they have done a less reasonable job. There isn’t more price transparency for the buy side from a practical point of view. These venues have the vast majority of the trade data. We would love to be stepping in and helping produce a consolidated tape. Probably, the venues would be our plan B, because we would ideally prefer a utility. A not-for-profit utility providing that tape would be in the interest of buy- and sell-side businesses. We need the option of multiple venues, we don’t want to see multiple tapes.

From an execution point of view and from a liquidity perspective, they have done a reasonable job. With issues such as creating greater price transparency post-MiFID II, they have done a less reasonable job. There isn’t more price transparency for the buy side from a practical point of view. These venues have the vast majority of the trade data. We would love to be stepping in and helping produce a consolidated tape. Probably, the venues would be our plan B, because we would ideally prefer a utility. A not-for-profit utility providing that tape would be in the interest of buy- and sell-side businesses. We need the option of multiple venues, we don’t want to see multiple tapes.

The International Capital Market Association (ICMA) working group paper recommended that ESMA might provide it, would that be a good option?

I worked on that white paper and ESMA have declined. They returned with the idea of maybe creating multiple consolidated tapes. That clearly doesn’t work. Now we are still trying to push through with ICMA, the Investment Association (IA), Quorum 15, and it’s going to have to be an effort together, to find somebody who will produce it and ensure what is produced offers high-quality transparency while at the same time allowing the appropriate level of protection to market participants.

The challenge in the short-term is Brexit. How it falls is the game changer as to whether we need a European tape or a UK tape, or whether we can actually consolidate all that data.

I understand people’s reluctance to step into that space at this point in time but we need to keep pushing it, to ensure that when we get to the other side of Brexit, we are in a good place to produce something, because this is not going to be produced in the next 12 months.

Why is it so problematic given the demand?

It is potentially difficult to monetise. How do you charge, who do you charge, where do you charge it from? ESMA has said it is not in that kind of business.

What is the importance for the asset management industry?

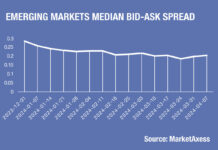

The importance to the buy side is not just transparency, it is potential tightening of spreads, which is what happened when TRACE went live in the US. The buy side are very conscious of our costs and where our data is going. The buy side has ended up in a situation where they are paying to send their data out to vendors to meet their regulatory reporting requirements, and then potentially paying to have it aggregated and sent back. Basically paying twice for it.

Looking at the desk itself, how has the skill set that you need as the head of trading changed over the last five years?

It’s changed hugely. Previously it was more an execution-only role. Now the feedback from traders and input towards investment processes is becoming more important. Dealers are not taking alpha or risk onto the books but they need to be involved in the investment process, providing constant market feedback, alternative solutions and recommendations where needed.

How does that sit with your new role?

At Royal London Asset Management our portfolio managers are super nimble. Their niche is reacting in real time to what is available to trade, having the skill set to buy small and illiquid bonds, so feedback from trading is crucial to ensure they don’t lose that key advantage.

Our rates team are really strong; they take a view and are happy to be the counter to the markets to get into a position. That’s really important for the funds to get the gains out of those small moves around numbers and have proactive trading. If dealers aren’t communicating with the portfolio managers, those kinds of advantages can slip by.

While environmental, social and governance (ESG) is increasingly becoming a buzz word in the industry, ESG analysis has been at the core to the investment philosophy of our Sustainable and Global Equity Teams for more than 15 years. The Sustainable Team joined the business in 2014, when RLAM acquired the Cooperative Asset Management, and our Global Equity team joined RLAM in 2017 from Waverton. RLAM has a long-established history in integrating governance, active ownership and engagement across all of our equity funds and we regularly comment and contribute to the public debate on governance and stewardship issues in the UK.

Does that mean your relationship with the sell side is more important than for firms that are trading more electronically?

Yes, we trade everything we feel is appropriate to trade electronically and it would be our first choice for execution. However, the reality is for relatively illiquid paper, electronic trading can cause more harm than good in terms of information leakage. Therefore, we need to engage voice to protect market and minimise our foot print. Also a lot is traded on the reverse enquiry; where we are shown a natural block by counterparties who know what kind of assets we like to trade; this is where the sell side can add real value.

How does communication between the trading team and the portfolio management function?

The desks are physically located close to the PMs so we can actually turn around and talk with the portfolio managers and they can call back. The skill set required of the trader is very different today than five years ago. We need to be super comfortable with change and an evolving environment, to be able to embrace technology, to understand what we are using.

Data mining techniques or a quantitative background is important. A trader must be able to look at a bigger picture. For example, with my new role I need to look at my infrastructure, the vendors we are using and utilising, and then what is available outside.

Our budget is not unlimited, like any house, so I need to look at cost efficiencies on existing platforms. We need to be super careful about where we allocate resources, to make sure it is actually adding real value and real return to our clients and policy holders.

There has been a longstanding issue of connectivity between different platforms, is that being tackled or addressed?

It’s strange to say in this day and age but connectivity can be an issue. OMS, execution platforms, data providers, vendors and other utilities can all struggle to connect; at the heart of which lies our Order Management Systems (OMS). The OMS can be reluctant and slow to connect to any technology. Their reasons would be they can’t connect to every initiative, and like us they don’t know who will be around tomorrow, but conflicting competitive interests may also come in to it.

I can imagine the number of requests they get from their clients and vendors. However it’s a real stumbling block because as we get more and more electronic, if you do not have straight through processing from an OMS, then it doesn’t matter what service you are offering, people won’t connect to you.

How do things stand with MiFID II at this point?

The last challenge is RTS 27 and Article 65 at the end of April. That said, business as usual requirements under MiFID II are ongoing and the conversations aren’t going to dry up any time soon. People will improve and hopefully perfect their standard of reporting, their documentation, and governance. I think most people met the requirements and will be looking to build and create the gold standard on those going forward.

You recently had 600 applicants for positions, are you finding the skills you need from that base?

Absolutely, I think there are quite a lot of people who are very aware of how the industry is changing, and very keen to get into the buy side. We had a lot of sell side interest too, I think the sell side are feeling a little bit more disengaged from their clients because of the increase in electronic trading. Portfolio managers are my clients, they are internal clients but they are every bit as important to us as sell side external clients. And, moving to the buy side gives a sell side person the chance to do what they really love, which is engage with their clients. In this case it’s the portfolio managers who are the clients, so we are seeing more people keen to move onto the buy side; definitely the skills are out there, and we have met some great people already.

How is the quantification of best execution going from your perspective?

For best execution it is about having a process in place. We still have a lot of manual documentation around fixed income and equity trades. Sometimes we don’t have enough competitive quotes or sometimes we can have zero quotes. We need a policy that allows us to transact business on very attractive deals for our portfolio managers where there is a lack of pricing transparency. In those cases you make sure your policies allow you enough room to proceed with the trade.

I see best execution and transaction cost analysis (TCA) overlapping to some extent. TCA can help me document best execution from a regulatory perspective. We use TCA to do that today, to help us identify outliers; this is probably only a fraction of what TCA is actually capable of doing.

TCA can help us change the way we engage in the market from a trading strategy point of view. Had I done 5% of average daily volume (ADV) instead of 8% ADV would that have been a better outcome for the fund? That’s TCA. That’s above and beyond the best-ex requirement, as dealers don’t have the luxury of hindsight when they place a trade.

Then we look at the Execution Management Systems (EMS) which work on a whole different level. Not only do they aggregate our data, technologies and platforms but being able to have traders and dealers executing in a more efficient way can help with the timing of the investment decision. Some systems claim to more or less capture an unlimited amount of data points at every stage through the trade in an attempt to give dealers the pre-trade information to answer the above question. That level of information could change how we get the best possible investment return for our clients. The challenge is finding a truly multi-asset solution which can capture high quality data, to give us meaningful output.

Amongst your traders, do you have specialists or a team with skills across the range of different instruments that you trade.

The trading desks tend to be reasonably small in size, three on fixed income, and three on equity. Our equity team tend not to specialise, beyond European versus overseas specialists. Within the fixed income group everybody has to be a jack of all trades, it allows for specialisation but from a cover perspective we need everybody to be able to do everything.

How much leeway can portfolio managers give the trading team in making decisions?

Dealing has discretion over timing, strategy and with whom we trade.

To what extent do dealers support investment?

Dealers support the investment process in many ways, identifying liquidity, providing market colour to the portfolio managers, removing the regulatory and administrative burden of trading, allowing portfolio managers to focus on making key investment decisions.

One example would be that portfolio managers can tell us the type of paper that they are looking for. They could be looking for five-year euro or sterling-based paper using X per cent with a rating paper. Then we can actually go out, using a utility and search the inventory of the banks’ balance sheets, to find what is available to trade in that space. It’s usually advantageous to the portfolio managers, and it’s something new to the portfolio managers here in Royal London Asset Management. And it’s something that they really like and get value out of.

What are your goals for the upcoming year?

I want to create a best-in-class trading desk, I would like to help build stronger management information systems (MIS) which can add real value to our propositions in terms of achieving the best possible outcome for our funds, including monitoring, controls and governance. I would like to have had the opportunity to look at our existing technologies and think what we can do to improve our infrastructure, and evaluate what efficiencies there are in the market place. The road map for the future needs to be efficient and scalable.

©TheDESK 2018

TOP OF PAGE