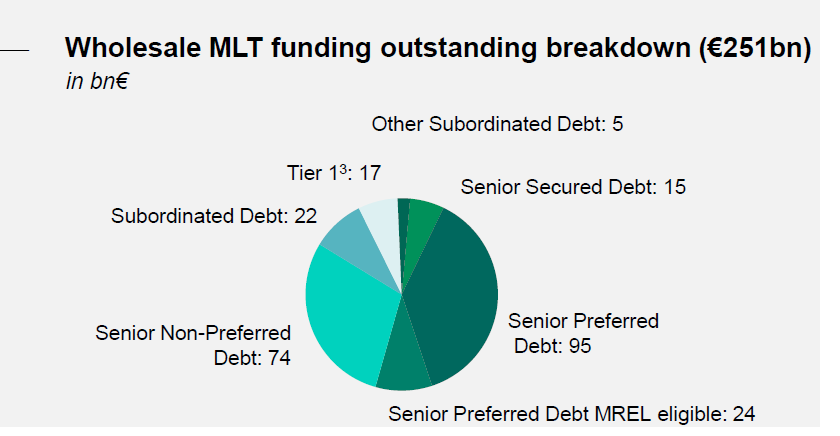

BNP Paribas was the largest bond issuer in Europe in Q2 2025, with €7 billion of debt placed in the market. In total it has €251 billion of medium to long term debt outstanding.

Approximately 80% of its 2025 regulatory issuance plan had been realised as of 7 July 2025, with €10.2 billion non-preferred senior debt issued so far this year, along with 2.3 billion of preferred senior debt, of the of the planned €16 billion issuance for 2025.

In addition the bank has issued €5.3 billion of the €6.5 billion of capital instruments issued for regulatory purposes.

On its Q2 earnings call, the firm said it expected to deliver net income of €12.2 billion includes a contribution from the recently acquired AXA Investment Managers.

Morgan Stanley’s analyst, Giulia Miotto, wrote, “We see the 12.5% common equity tier 1 (CET1) print, in line with consensus, as a positive, given that this was a concern going into results, due to model update impacts. Moreover, at Group level, the 5% underlying pre-provision operating profit (PPOP) beat was driven by a 1% beat on revenues, and a 2% beat on costs. Provisions came in 14% higher than consensus though, with €100mn impact coming from higher provision for CHF mortgages and consumer credit in Spain.”

“Given that capital is in line, and P&L is a beat, we expect a positive first share price reaction,” concluded Miotto

©Markets Media Europe 2025