Supply, gross

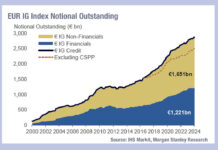

Debt markets are looking bloated in Europe, with a 33% increase in European non-financial investment grade issuance year-on-year (YoY) year-to-date and a 31% increase...

US HY volumes hit yearly highs post-Liberation Day

US high yield (HY) trading volumes hit yearly highs last week as the country comes to terms with the implications of Trump’s ‘Liberation Day’...

Serrano swaps Liquidnet for Tradition

Fausto Serrano has joined interdealer broker Tradition as North American head of electronic credit brokering. He is based in New York.

Tradition reported CHF 1.1...

Swinburne: Traders should beware of radical change in Europe

Brexit will mean that politics will take precedent over principal, when setting policy in Europe, warned Kay Swinburne MEP, speaking at the Fixed Income...

Me The Money Show – Episode Two

Terry Flanagan, editor of Markets Media, highlights previous winners of the Markets Choice Awards and gives tips on nominations for this year, with Dan...

CFTC & SEC: JP Morgan manipulated Treasuries market during flash crash period

US market regulators the Securities and Exchange Commission (SEC) and Commodity Futures Trading Commission (CFTC) have fined JP Morgan over US$920 million in penalties...

Exclusive: LedgerEdge to go into administration

LedgerEdge, the distributed ledger-based fixed income trading venue, has closed down.

Founder, David Rutter, said, “We can confirm LedgerEdge has closed, three years after...

On the DESK : Lee Sanders, AXA Investment Managers

Lee Sanders, head of Head of Execution at AXA Investment Managers believes that increasing automation is the biggest issue on buy-side trading desks.

How has...

NatWest issues fixed rate note via LSEG’s DCM Flow

NatWest has executed a ¥1 billion 5-year fixed rate note on the London Stock Exchange’s DCM Flow which is underpinned by Nivaura’s technology. DCM...

Thailand’s Government Pension Fund taps Charles River for front office management

Thailand’s government pension fund has selected State Street subsidiary Charles River Development to modernise its front office operations and manage its domestic and international...

List trading goes live on MTS BondsPro all-to-all order book

MTS Markets , part of London Stock Exchange Group (LSEG), has added list trading functionality to its MTS BondsPro corporate bond trading platform, enabling...

Euronext issues €600bn in Portuguese treasuries

Euronext Lisbon is issuing new floating rate treasury bonds (OTRV) on 18 July, maturing in July 2031.

The offering received a total €612 billion, €423...