“There is still an edge in systematic trading”

Systematic trading is often associated with highly liquid instruments, but asset managers have outlined success stories in less liquid debt markets, at the Fixed...

Hult: The dealer business is changing

Who are the big beasts of the bond markets today? The red ink on banks’ recent quarterly earnings reports writes the latest chapter in...

Exclusive: Rathbone Unit Trust Management outsources trading to Northern Trust

Rathbones, the investment and wealth manager with US$60 billion (US$74 billion) assets under management (AUM) has confirmed its Rathbone Unit Trust Management team is...

TS Imagine expands RiskSmart X margin calculation abilities

TS Imagine has boosted its sell-side financial risk management solution RiskSmart X with the CCP Margin Calculator.

Launched last year, RiskSmart X allows users to...

Irvine swaps Aberdeen for BNPP AM

Jamie Irvine has joined BNP Paribas Asset Management as a portfolio manager on the global aggregate and absolute return team.

Based in London, he reports...

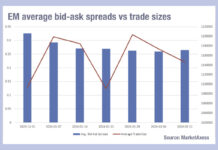

Emerging markets trading costs threaten to rise

Emerging market bond traders will see trading costs rising as volumes begin to decline. According to MarketAxess data from its CP+ pricing tool and...

FIX issues guide for MiFID II reporting of bond trades

By Flora McFarlane.

FIX Trading Community, which sets the messaging standard for trading messages sent between buy-side and sell-side firms, has published the final Recommended...

Fed names new sellers to SMCCF including Jane Street, Tradeweb

The Federal Reserve Bank of New York has released the the first wave of additional counterparties that it has selected to support the Secondary...

Viewpoint : Best execution in derivatives : Liam Huxley

Taking the proper steps

The DESK speaks to Liam Huxley, CEO of Cassini Systems about best execution in derivatives.

How well developed is the best execution process...

More EM platform consolidation amid liquidity challenges

Emerging markets have offered a strong opportunity for yield in recent years, albeit with greater credit risk and FX volatility, however getting access to markets...

SIFMA finds support for shift in benchmarking of 20-year US corporate bonds

The spread for many legacy 20-year US corporate bonds is benchmarked against the 30-year Treasury, but trade body SIFMA has found support for moving...

Fiscal policy, market regulation draw bond-market concern

As a still-new US presidential administration settles in and the Securities and Exchange Commission pivots with its own new leader, fixed income markets face...