Viewpoint: Ruben Costa-Santos & Milan Borkovec

Fixed income analytics comes of age.

By Ruben Costa-Santos, Head of Multi-Asset Analytics, and Milan Borkovec, Head of Analytics Quantitative Research at Virtu Financial.

Under MiFID...

Leveraged loan market ripe for innovation after 2023 revenue bump

US dealer revenue hit US$900 million in 2023, representing a 16% increase against 2021 and a 29% bump on 2022, attributed to a renewed...

EMSs connect the dots in bond trading

Increased integration between venues and trading tools could herald far greater automation.

Moving a fixed income order from a portfolio manager to a counterparty is becoming...

The Book: Stellantis issues US$1.9bn debt, faces US$2.7bn loss

Auto manufacturer Stellantis has reported a US$2.7 billion loss in the first half of 2025, results that chief financial officer Doug Ostermann described in...

BlueCrest hit by £40m fine by FCA

Fund manager BlueCrest has been fined just over £40 million by the UK’s Financial Conduct Authority (FCA) for inadequate disclosures to investors, regarding its...

FCA to investigate barriers for buy side to access data

The UK’s market regulator, the Financial Conduct Authority (FCA) will launch two market studies and gather further information to investigate access to wholesale data....

Barclays: European portfolio trading to hit 18% in three years

Portfolio trading share in Europe’s investment grade market could get closer to that of the US from its current 10–12% level in volume to...

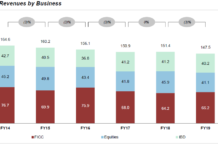

Fixed income up as investment bank revenues and headcount drop

Fixed income, currencies and commodities (FICC) revenues were up 3% year-on-year for investment banks in 2019, halting a two-year slide, according to the latest...

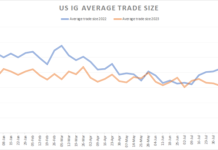

Are average trade sizes really falling in the US?

Earlier this year we noted that average trade sizes were down considerably on 2022, but being wary of mean reversion, we wanted to revisit...

Demand for private debt, IG bonds grows in APAC

Investment grade (IG) bonds, private debt and multi-asset funds will be top of mind for investors over the next year, according to Asian fund...

Mosaic Smart Data and Limeglass boost research analytics for banks

Analytics provider Mosaic Smart Data and Limeglass, the financial research specialist, have formed an alliance to help banks analyse research reports associated with client...

This Week: Dwayne Middleton, T. Rowe Price

T. Rowe Price: Adapting fixed income strategies and identifying the potential of agentic AI

Dwayne Middleton, global head of fixed income trading at T. Rowe...