BGC’s FMX goes live with Marex executing first trade

BGC Group launched its highly anticipated FMX Futures Exchange on Monday, opening for SOFR futures trading at 9 PM ET.

Marex cleared the first trade...

Tradeweb’s annual client letter – in full

The annual letter to clients from Tradeweb’s CEO and chair, Lee Olesky, and president and CEO-elect, Billy Hult, has been published, noting the tough...

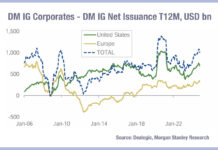

Primary held in check by tariff and rate uncertainty

Gross credit issuance has fallen in developed markets, according to data from Dealogic and Morgan Stanley, across investment grade (IG) and high yield (HY).

DM...

Exclusive: Karim Awenat promoted at Invesco

Karim Awenat has been promoted to head of EMEA and APAC macro trading at Invesco, which has assets under management of US$1.6 trillion. Awenat...

Tradeweb and MarketAxess see credit volumes increase over 25% in December

Market operators MarketAxess and Tradeweb have released their December trading levels, with both seeing a monthly increase of 25% in credit trading average daily...

Bloomberg makes its real-time B-PIPE data feed available on AWS

Bloomberg's flagship real-time market data feed, B-PIPE, has been available on the cloud via Amazon Web Services (AWS), giving clients access to the same...

Market data ‘Bill of rights’ opens discussion on transparency, accessibility and ownership

A week after the UK’s Financial Conduct Authority announced a consultation into buy-side access to data and benchmarks, bond pricing specialist BondCliQ and data...

Cboe begins publishing VIXTLT index to enhance volatility tracking

Cboe Global Markets has begun publishing intraday values for its 20+ Year Treasury Bond ETF Volatility Base Point (VIXTLT) Index.

The VIXTLT Index allows market...

Insight & Analysis: Eighty percent of liquidity disappeared from long bond future post 2...

Ten ticks’ depth of order book collapsed as liquidity providers fled unprecedented volatility, analysis from The DESK shows.

After an initial flight to safety on...

FCA warns on permissions needed for MiFID II

By Sobia Hamid.

Firms who need to change their regulatory permissions as a result of MiFID II, in effect from 3 January 2018, are advised...

The Agency Broker Hub: How agency brokers are shedding their skin

By Umberto Menconi, head of Digital Markets Structures, Market Hub, Intesa Sanpaolo Group*

The agency broker has always played one of the principal roles on the...

Sukh Bachal hired by Neovest as co-head EMEA

Order/execution management system (OEMS) provider Neovest has hired Sukh Bachal as co-head Neovest EMEA and head of EMEA business development. Bachal was until recently...