Market Structure: New risk and liquidity in the US Treasury market

Significant changes in counterparties and market structure have transformed US Treasury market activity.

Dealer-to-client trading has overtaken interdealer markets in volume traded according to analyst...

Greenan joins Aquis

John Greenan has joined Aquis Exchange as director of technologies.

Based in London, Greenan is responsible for the sales and contracting activities of the firm’s...

Fed: No bond ETF fees for BlackRock; JP Morgan still AWOL

Under the new Federal Reserve asset purchasing programme, BlackRock, the asset manager which is acting as the trading function for the programme, will charge...

Broadway Technology’s fixed income spin-off raises questions about competitive landscape

The UK’s Competition and Markets Authority (CMA) has agreed the takeover of Broadway Technology by ION Trading Technologies, allowing ION to expand its grip...

IHS Markit and CBPC open up China’s bond market with new onshore indices

By Shobha Prabhu-Naik.

Business information provider IHS Markit has launched new onshore Chinese bond market indices, which it claims are the first international, independent fixed...

Industry viewpoint : SIX Swiss Exchange : Frédéric Messein

Better interdealer execution generates natural liquidity

Banks’ reticence to trade with clients is a consequence of the cost of carrying risk; SIX Corporate Bonds de-risks...

FILS in Barcelona: The modernisation of the bond market

A massive modernisation of the bond market is being recognised at the Fixed Income Leaders’ Summit in Barcelona.

Although the event was largely held...

ING’s AI is smarter at pricing bonds

By Flora McFarlane.

ING has launched Katana, a new artificially intelligent (AI) bond trading tool which uses predictive analytics to help price trades for clients....

Viewpoint : Gareth Coltman : MarketAxess

Smarter trading – Data and auto execution

An interview with Gareth Coltman, Head of European Product Management, MarketAxess.

How is automation manifesting on the buy-side desk...

BMO to redeem Series J Medium-Term Notes

The Bank of Montreal (BMO) has announced its intention to redeem all its US$1,000,000,000 Series J Medium-Term Notes (Non-Viability Contingent Capital (NVCC)) (Subordinated Indebtedness)...

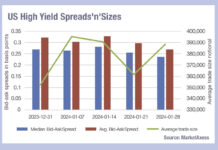

Tighter spreads, bigger trades

Credit markets have largely seen tightening bid-ask spreads since the start of the year on both sides of the Atlantic – some segments more...

S&P Global Ratings: European credit spreads still wide

In its latest ‘Europe Credit Markets Update’, S&P Global Ratings has painted a grim picture for European borrowers, notably in the high yield space,...