Five dealers select Droit for MiFID II Compliance

By Flora McFarlane.

BNP Paribas, Crédit Agricole CIB, Goldman Sachs, Lloyds and UBS are using Droit Financial Technologies for MiFID II trade compliance infrastructure.

Jo Hannaford,...

The Autonomous Trader

Separating the trading function from portfolio management is a painful exercise, but the benefits can be felt by the end investor. Dan Barnes reports.

Buy-side...

Clearlake Capital and Motive Partners to acquire BETA+ from LSEG

Private equity firms Clearlake Capital Group and Motive Partners have agreed to acquire the BETA+ assets from London Stock Exchange Group (LSEG), encompassing the...

SEC fines Bloomberg US$5 million for failure to disclose single quotes as BVAL source

Market operator and data provider, Bloomberg, has been fined US$5 million by US market regulator the Securities and Exchange Commission (SEC) for failing to...

Jefferies moves into outsourced fixed income trading with Siegel hire

Industry veteran Jory Siegel has joined Jefferies as head of fixed income outsourced trading, from Marex.

Siegel was previously managing director and head of fixed...

JP Morgan chooses Mosaic fixed income data analytics platform

By Flora McFarlane.

In a move to increase the efficiency and efficiency across its FICC sales and trading division, JP Morgan has contracted Mosaic Smart...

BofA: ‘Universal gloom’ in fund manager survey

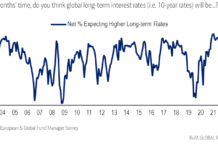

The latest fund manager survey by BofA has found that a net 92% of survey participants expect a recession in Europe over the next...

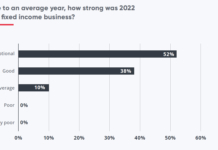

Dealers had ‘exceptional’ 2022 for fixed income; JP Morgan tops Q1 DCM winners

Research by front-office technology provider, valantic FSA, and analyst firm, Acuiti, has found that 52% of dealers had an ‘exceptional’ year for fixed income...

Tradeweb joins forces with Boerse Stuttgart, sees Q2 revenues up 19%

Market operator Tradeweb is partnering with Boerse Stuttgart to offer the German exchange’s users direct access to liquidity in US bond trading. The exchange...

TMPG warning on failed trades for US Treasuries settled outside US

The Treasury Market Practices Group (TMPG) has released an updated version of the group’s Frequently Asked Questions: TMPG Fails Charges to clarify two issues.

The...

The breakdown: How asset managers are tackling fixed income unbundling

By Flora McFarlane & Dan Barnes.

With the revised Markets in Financial Instruments Directive (MiFID II) set to arrive in just under five months, buy-side...

Primary concern : FIXing issuance

Efforts are underway to automate debt offerings and give the buy side greater control. Lynn Strongin Dodds reports.

Initial public and debt offerings can be...