Coalition Greenwich: Regulation and macro concerns dominate for derivatives users

A new report, ‘Derivatives Market Structure 2024: Focusing on Capital and Workflow Efficiency’, has found that 58% percent of end users of derivatives, and...

This Week from Trader TV: Ben Ashby, Henderson Rowe

Markets brace for conflicting liquidity shifts, a potential correction, AI bubble risks.

New Trader TV - Ben Ashby, chief investment officer at Henderson Rowe, discusses...

FILS USA: How can high yield be traded efficiently in a risk off environment?

Banks are stepping back from taking risk in high yield trading. Trading in a risk-off environment in normal circumstances can be challenging as spreads...

Nicolas Pilorget promoted at Ontario Teachers’ Pension Plan

Ontario Teachers’ Pension Plan (OTPP) has appointed Nicolas Pilorget as head of credit trading. He is based in Toronto.

Pilorget has been with the company...

Tradeweb announces JSCC clearing for MTF and SEF Yen swaps

Multi-asset market operator, Tradeweb has reported that institutional clients executing Japanese Yen swaps on its multilateral trading facilities (MTFs) and swap execution facilities (SEFs)...

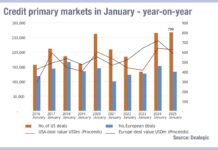

Retreat in credit market primary activity in January 2025, Munis a bright spot

In January 2025, Debt Capital Markets (DCM) for credit issuance retreated in the US and in Europe while primary activity for municipal bonds (Munis)...

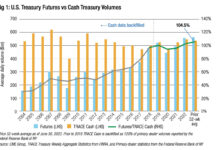

FILS in Barcelona: If the future is futures, what happens when the market is...

Moving liquidity from the spot or cash markets into futures is raising some concern amongst market participants. In FX, trading volume on the Thomson...

Investor Demand: Private credit set for another bumper year – but risks rumble

Global private credit markets will grow in 2025, Moody’s Ratings has predicted.

A number of factors are behind this growth, the firm’s report said, including...

What Mexico’s vol risk means for trading LatAm bonds

In Latin American (LatAm) markets, economic volatility may transfer into market volatility – most notably in Mexico.

In order to manage risk and seize opportunities...

Research Profile: DirectBooks

The electronification of primary bond markets is a priority for buy-side firms this year, and DirectBooks, originally formed by a consortium of nine global...

Subscriber

Why Europe’s electronic credit trading is accelerating

The level of electronic trading in European corporate bond markets has overtaken the US, according to analysis from firms including Propellant and Coalition Greenwich....

UK to allow shorting of government debt and sovereign CDS

The UK Government has said it will remove requirements currently placed on investors when taking out short positions in sovereign debt or sovereign credit...