LTX launches BondGPT powered by OpenAI GPT-4

LTX, the market operator division of Broadridge Financial Solutions has launched BondGPT, an application powered by OpenAI GPT-4 that answers bond-related questions and assists...

Tradeweb Reports Record ADV of $2.2 trillion

Tradeweb Markets, a leading, global operator of electronic marketplaces for rates, credit, equities and money markets, reported financial results for the quarter ended September...

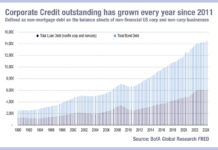

I just dropped in to see what condition my credit was in…

Credit conditions are in the headlines following several private credit defaults, and the debt-fuelled, forward investment in data centres which are expected to underpin...

Refinancing debt: New bonds, old problem

A new paper from Bank of America’s credit strategist Neha Khoda and Adam Vogel has found that bond issuers are facing a significant increase in costs...

Visualising aggressive pricing pressure on trading costs

Analysing year-to-date volume and trade number data from MarketAxess’s TraX database for US credit, and correlating it with the weekly average MarketAxess CP+ bid-ask...

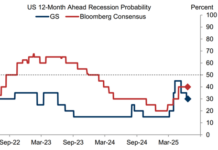

Insights and analysis: Goldman cuts US recession probability to 30%

In a research piece from 21 June, Goldman Sachs economist Jan Hatzius provides an improved outlook on US economic conditions as tariffs expectations stabilised....

BIS: Cut your trading costs in half by cosying up to dealers

A new working paper, written by the Monetary and Economic Department of the Bank of International Settlements, has found that dealer relationships are crucial...

New ECB harmonisation rules push for capital markets union

The European Central Bank (ECB) has published harmonised rules and arrangements for the mobilisation and management of collateral in Eurosystem credit operations in its...

SIX tokenises corporate bonds to expand investor base

SIX Digital Exchange (SDX) has completed its pilot project tokenising corporate debt instruments in collaboration with Banque Pictet.

Fractional quantities of the tokenised assets were...

US credit issuance hit record highs in September

US credit issuance was at its highest level since May 2020 at the start of September, pushing average daily notional volumes up 4% year-on-year...

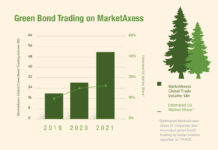

Trading for Trees

In 2019 MarketAxess launched their “Trading for Trees” program, under which five trees are planted by One Tree Planted, a partner charitable organization, for...

BlackRock loses senior market structure team as Winnike departs

BlackRock has lost its second senior market structure specialist in a few weeks as Michael Winnike, director, market structure at BlackRock, left the firm...