Bond funds hit by massive fee discounts; active revenues predicted to fall

Bond funds are dropping their investment management fees by up to 37% - in the case of passive funds – from those of the...

Eurex expands FX Futures offering to emerging markets currencies

Eurex will start trading new FX Futures contracts covering Brazilian Real (BRL), Mexican Pesos (MXN) and South African Rand (ZAR) on 10 October 2022....

Repo ripe for evolution

The broken mechanics of the repo market have been exposed creating demand for change says Roberto Verrillo, Head of Strategy and Markets at Elixium.

“Those...

Glimpse Markets and Wave Labs partner to deliver analytics dashboard

Buy-side bond data sharing service Glimpse Markets and Wave Labs, the execution management system provider, have formed a strategic partnership whereby Wave Labs will...

Announcement – The DESK Q1 2020

The Q1 issue of The DESK is due from the printer and under the current exceptional circumstances we are happy to re-direct your copy...

FCA consultation lays ground for ending bond SI regime

The FCA’s consultation CP25/20 proposes scrapping the systematic internaliser (SI) regime for bonds, derivatives, structured-finance products and emission allowances to align with the transparency...

Origination: Carnival eyes IG market with €1 billion issuance

Carnival Corporation and plc have closed their €1 billion senior unsecured notes private offering. The senior unsecured notes have a coupon of 4.125% and...

TradeTech 2023: Fixed income increases share of ETF world

Fixed income is becoming a larger part of the exchange traded funds (ETFs) universe as investors and traders seek greater flexibility and liquidity, according...

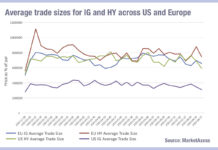

Analysing the split between US and EU investment grade trade sizes

Recent reports that high yield (HY) trades are increasing in size and investment grade (IG) are shrinking, have ignored the year-on-year growth of European...

FILS USA 2023: Market volatility has tested e-trading and instrument selection

Having had a challenging and volatile first half of the year from a liquidity perspective, not least because of a crisis in US and...

Reports: MTS to launch D2C initiative with backing from major dealers

Several market sources have reported that MTS Markets, the fixed income trading division of Euronext, is to launch a dealer-to-client credit trading offering through...

IHS Markit publishing new CRITR US dollar funding rate

Information, analytics and solution provider, IHS Markit, is now publishing a series of forward-looking dynamic term rates that measure the daily US Dollar (USD)...