Deming joins CalPERS from Allianz GI

Amy Deming has been named investment director with responsibility for investment controls and operational risk at California Public Employees Retirement System (CalPERS), the US...

BrokerTec integrates relative value curve spread trading with Broadway Technology

Fixed income and FX trading platform, BrokerTec, has partnered with Broadway Technology to make its relative value (RV) curve spread trading functionality available on...

Will Pagano departure lead Citi to reset EM credit trading approach?

The departure of Marc Pagano, Citi’s managing director for emerging markets credit trading, has raised mixed feelings amongst buy-side traders. Although one in a...

The DESK’s Trading Intentions Survey 2020 : Unpicking the buy-side workflow

We reveal the buy side’s use of platforms for pre-trade data, executing orders in the market and trading venues.

Trading Intentions Survey highlights

Bloomberg has...

Subscriber

Voice trading remains prevalent in Treasury trading

Citadel Securities is conducting a third of its Treasury risk by voice, according to a representative. Kevin McPartland, head of research, market structure and...

Credit futures see OI and ADV increase more than sevenfold YoY

The adoption of credit futures as a mainstream credit trading vehicle is broadening across venues and currencies: US$ iBoxx total return based futures traded...

Scott swaps JP Morgan for Bloomberg

Ryan Scott has joined Bloomberg’s rates electronic sales team. He is based in New York.

Last year, the firm released a report suggesting that automated...

Rules & Ratings: Delta gets a positive outlook upgrade at Fitch

Fitch Ratings has revised Delta Art Lines’ credit rating outlook from stable to positive, and affirmed its BBB- long-term Issuer Default Rating (IDR).

This change...

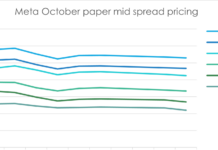

Origination: Meta sold US$30 billion of AI bonds on 30 October

Meta Platforms, the US investment grade social media platform operator, priced and sold a six-part dollar deal, with a net value of US$30 billion,...

July 2023: Tradeweb sees total credit ADV jump 30% YoY in July driven by...

At Tradeweb, in July 2023, fully electronic US credit ADV was up 34.8% YoY to US$4.8 billion and European credit ADV was up 38.6%...

Opinion: Regulators need to prioritise closing the market making gap

The one thing bond markets are really in need of, is more two-way liquidity in stressed markets. Yet that is nowhere on the regulatory...

SIFMA finds support for shift in benchmarking of 20-year US corporate bonds

The spread for many legacy 20-year US corporate bonds is benchmarked against the 30-year Treasury, but trade body SIFMA has found support for moving...