Making prices more easily

If dealers cannot make prices investors will have to, and many firms are stepping up to offer greater access to pricing and liquidity data....

SEC committee signals direction for US credit rules

New fixed income committee sees pushback on structural approach to resolving credit market challenges. David Wigan reports.

As European fixed income market participants get their...

JP Morgan veteran poached by Old Orchard Capital Management

Jared Fand has joined New York-based investment management firm Old Orchard Capital Management as a trader, leaving JP Morgan after more than a decade...

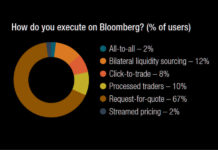

The DESK’s Trading Intentions Survey 2020 : Bloomberg

Bloomberg has a strong position as data provider, interface into the market and a trading venue.

The ubiquitous terminal allows it to build new services...

Subscriber

Credit Suisse and VTB fined millions by UK, US and Swiss authorities over Mozambican...

Credit Suisse Group AG has agreed to pay nearly US$475 million to Swiss, UK and US authorities, including nearly $100 million to the US...

Etrading Software to provide UK bond CT

Etrading Software has been awarded the consolidated tape provider (CTP) contract in the UK.

The £4.8 million contract (£4 million excluding VAT) is estimated to...

LCH Group to assume full ownership of LCH SA from Euronext

Euronext is to sell its 11.1% stake in LCH SA, the French subsidiary of LCH Group, for €111 million, to majority stake holder LCH...

Strong YoY growth in US rates volumes

Average daily notional volumes (ADNV) for US rates dropped between April and May as uncertainties around trade policies and tariffs muted demand, but were...

Regulation: innovation sees European corporate bond market’s electronification outpace US

When it comes to electronic trading, Europe’s corporate bond market is racing ahead of its US counterpart, with two thirds of European investors looking...

Secular vs cyclical: How e-trading, issuance and credit spreads align with liquidity

Primary markets are a crucial source of liquidity in secondary markets, as new issues trigger a round of buying and selling activity for newly...

AxeTrading founders step back from management

AxeTrading has announced that the founders of the firm, together with other members of the Board, have agreed that in order to address “the...

In retail fixed income, trust trumps education

Fixed income markets are complex and esoteric compared with equities.

Retail market participants are more interested in bonds than they had been for years, given...