Octaura partners with CreditSights for enhanced data provisions

Clients of syndicated loans electronic trading, data and analytics firm Octaura will soon be able to access LevFin Insights (FLI) data and news through...

Competition for debt issuance fierce as activity remains

Primary debt markets are likely to be a major revenue earner for dealers facing tighter margins in secondary bond markets. Issuance has started strongly...

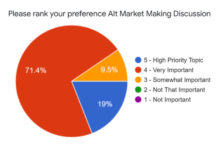

Credit Market Structure Alliance: The real market agenda

The CMSA, invitation-only event, is setting an agenda based on market professionals’ concerns, and has captured a groundswell of interest.

The DESK: What has been...

Subscriber

AFME urges co-legislators to ensure EU market attractiveness as MiFIR trilogues begin

The Association for Financial Markets in Europe (AFME) has issued a comment in response to the vote of the European Parliament's Committee on Economic and Monetary Affairs (ECON) on...

Cohen joins Cabrera

Daniel Cohen has joined Cabrera Capital Markets as head of municipal trading.

Based in New York, Cohen has more than two decades of industry experience....

ICE: Size-Adjusted Pricing (SAP)

Shifting odd lot dynamics throw a spotlight on ICE’s Size-Adjusted Pricing

A dramatic jump in small trade volumes, driven by increased retail and electronic...

Liquidnet launches primary bond market offering as buy side demands innovation

Block-trading specialist Liquidnet is launching into the primary market technology space. Its new electronic solution, Liquidnet Debt Capital Markets (DCM), is focused on new...

E-trading platforms show mixed results in October’s market share battle

Electronic trading fixed income platforms saw a slight drop off in volume relative to October, but strong activity against the same period last year.

Bond...

“Way more flexibility than at Eurex”: Euronext announces govie mini-futures

Euronext is launching cash-settled mini-futures on European government bonds this September, which it says are the first offering of this kind in Europe.

“This is...

Axe Trading appoint new CEO

Greville Lucking appointed CEO at AxeTrading

LONDON, 13 April 2022 – AxeTrading, the fixed income trading software company, announced today the appointment of Greville Lucking...

SEC pushes back “unreasonable” broker-dealer compliance deadline

The Securities and Exchange Commission (SEC) has pushed back the compliance date for amendments to its broker-dealer customer protection rule (15c3-3).

The amendments will now...

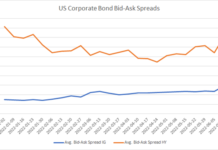

FILS USA 2022: Credit sees bid-ask spreads widen as volumes seesaw

Every trader attending FILS will be keeping an eye on the markets, as bid-ask spreads continue to tick upwards and volumes remain choppy.

Looking at...