Mapfre adopts Aladdin for execution, investment management

Mapfre AM, the asset management division of Spanish insurance company Mapfre which holds €57 billion in assets under management, has adopted BlackRock’s investment management...

Julian Hill joins UBS Asset Management

UBS Asset Management has hired Julian Hill as a fixed-income rates trader in London.

Hill arrives from Bloomberg, where he spent 18 months as...

Governance key to EU consolidated bond tape’s success

The International Capital Markets Association (ICMA) has published a report outlining the possible routes to delivering a successful consolidated tape of price data of...

The Book: Türkiye issues its first digitally native note

Türkiye İş Bankası (İşbank) has issued Türkiye’s first digitally native note (DNN), facilitated by Euroclear.

The US$100 million DNN was issued on Euroclear’s Digital Financial...

IHS Markit’s thinkFolio and Wave Labs partner

IHS Markit’s thinkFolio investment platform is partnering with Wave Labs, a firm that has created fixed income tools to deliver a functional window for...

AxeTrading and Mosaic Smart Data collaborate on bond market analytics

AxeTrading, the fixed income trading software provider, and Mosaic Smart Data, the real-time capital markets data analytics company, are integrating the AxeTrader execution management...

ICE Bonds builds on corporate bond volume records

ICE Bonds has introduced price improvement volume clearing (PIVC) to its risk matching auction (RMA) corporate bonds protocol.

RMA executes dealer-to-dealer sweep auctions, matching buyers...

FCA voices concern over buy-side transparency

By Pia Hecher.

The Financial Conduct Authority (FCA) has reported concern around cost-disclosures by asset managers, and following a ‘Call for Input’ (CfI), also detected concerns among...

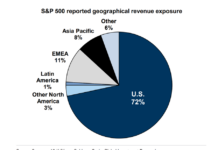

Insights and Analysis: Uncertainty reigns in trade war, rate impact expected

The inevitable effect of increased tariffs imposed by the US markets on trade partners – which may include the European Union, Canada and Mexico...

ICE: Muni Bonds – an interview with Ed Paulinski

In ICE’s series ‘The Munis Ecosystem’, ICE gathers experts from across the sector: issuers, portfolio managers, pricing & analytics, trading and climate experts, to...

Thomas Pluta named president-elect at Tradeweb

Tradeweb Markets has named markets veteran Thomas Pluta as its next president. He will join Tradeweb from JP Morgan, where he spent nearly 27...

Ben Londergan joins Simplex Trading

Simplex Trading has appointed Ben Londergan as managing director of strategic business development.

In the Chicago-based role, Londergan is responsible for driving the firm’s growth...