FINBOURNE completes Series B funding round

FINBOURNE Technology has raised £55 million in Series B funding, led by Highland Europe and AVP. The firm remains majority employee owned.

The results follow...

What do shorter durations imply for trading?

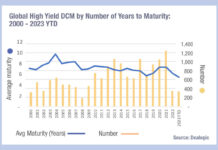

Data from Dealogic shows that the average maturity for newly issued bonds has been falling in 2023 relative to recent years, with the current...

Viewpoint : Gareth Coltman : MarketAxess

Smarter trading – Data and auto execution

An interview with Gareth Coltman, Head of European Product Management, MarketAxess.

How is automation manifesting on the buy-side desk...

Erik Tham leaves UBS Wealth for MarketAxess

Erik Tham has joined MarketAxess as head of Private Banking, for Benelux and Switzerland, leaving his position as executive director at UBS Wealth Management,...

Tom Nickalls leaves Ninety One

Morgan Stanley has appointed Tom Nickalls as a trader within its emerging markets credit team, effective August. He is based in London.

Nickalls has more...

Me The Money Show – Green Bonds

Me The Money Show Episode 17 from Markets Media on Vimeo.

Investors are ramping up demand for green bonds, with issuers seeing a positive appetite...

Investor Demand: European corporate debt plays second fiddle to the US

Zachary Swabe, total return portfolio manager for European high yield and global credit at UBS Asset Management, spoke to The DESK about the current...

FTSE Russell weighs country accessibility for fixed income traders

FTSE Russell, the index and data firm, is introducing a country classification process for fixed income. The newly introduced fixed income framework, which is...

The DESK on Radio 4’s Thinking Allowed

The Desk's managing editor, Dan Barnes, was a guest on BBC Radio 4's Thinking Allowed, discussing the role of retail traders in the market,...

Bajaj Finserv Asset Management adopts Bloomberg AIM

Bajaj Finserv Asset Management Limited (BFAML), has adopted AIM, the Bloomberg order and investment management system (O/IMS).

BFAML reportedly selected Bloomberg AIM in an effort...

Beyond Liquidity: Tokenization could improve bond liquidity & transparency

Bond markets could potentially use tokenization to improve efficiency, liquidity and transparency according to the Hong Kong Monetary Authority (HKMA) as consultancy McKinsey said...

Picturing uncertainty in a traditionally stable market

Trading numbers in secondary corporate bond markets appear to reflect anecdotal reports of volatility bursts, as political false starts impact the reading of major...