Aegon: Emerging market debt strong as sovereign default fears dissipate

Emerging Market Debt (EMD) is enjoying a “favourable” start to 2024, with growth, falling inflation and monetary easing trends across emerging economies acting as...

Derivatives: Credit default swaps – The revival

Applying innovation from corporate bond markets to credit derivatives trading could boost liquidity at a point of market stress.

Single-name credit default swaps (CDSs) provide...

Viewpoint : Empowering the PM : Jonathan Gray

Liquidity opportunities for the fixed income portfolio manager

Jonathan Gray, Head of Fixed Income EMEA, Liquidnet

The corporate bond market has changed dramatically in the last...

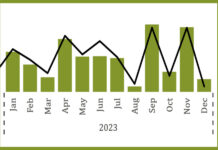

High yield bond issuance relative to liquidity

A report by the Association for Financial Markets in Europe (AFME) has found that primary issuance of European high yield (HY) bonds in 2023...

Low issuance volumes may impact the momentum to reform primary markets

Platforms keen to emphasise longer term commitment to electronification and greater automation.

Multiple platforms have been launched to drive increased efficiency in managing bond issuance,...

IDX 2024: Tokenised collateral could accelerate clearing

Conversations around tokenisation have been ramping up over the last six to nine months, according to speakers on the ‘Promise of Tokensation’ panel at...

Case Study – SURA Investments: How technology is transforming trading in Mexico and beyond

Bringing LATAM markets together

As one of the leading asset managers in Latin America and a pioneer in e-trading, SURA Investments* sought a global partner...

Pham replaces Behnam as CFTC chair

Caroline Pham has been named acting chairman of the Commodity Futures Trading Commission (CFTC), replacing Rostin Behnam.

Behnam announced his departure earlier this month, after...

Fed begins buying corporate bonds

The Federal Reserve Board has announced the Secondary Market Corporate Credit Facility (SMCCF), will begin buying a corporate bonds to support market liquidity and...

Singer Capital Markets appoints Gareth Henderson head of trading

Investment banking firm Singer Capital Markets has appointed Gareth Henderson its new head of trading.

Henderson has been head of market making at Singer Capital...

Alison Hollingshead joins Jupiter AM

Alison Hollingshead has joined Jupiter Asset Management as chief operating officer for investment management.

“I am delighted to be starting my new role as COO,...

Corporate Bonds : Shuttering & Buffeting : Lynn Strongin Dodds

NETS CAST WIDE AS HIGH YIELD IS SPREAD THIN.

With Third Avenue and Lucidus putting high yield in the headlines, traders and portfolio managers are defining...