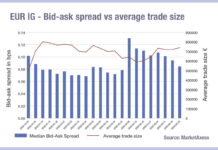

Liquidity recovery continues in European investment grade

The careful return to pre-trade-war bid-ask spread levels continues in European credit markets, according to data from MarketAxess TraX, which assesses trading across multiple...

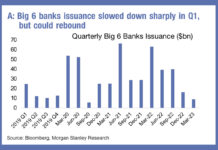

Keep an eye on bank issuance

Bank bond issuance is expected to pick up this year according to research by Morgan Stanley analysts. With deposits proving less attractive as a...

Subscriber

No Danish Compromise for BNP Paribas

BNP Paribas has finalised its acquisition of AXA Investment Managers (AXA IM) and clarified its leadership structure going forward.

The firm has not been able...

BondVision prepares for T+1 shift

MTS’s BondVision (part of the Euronext group) has updated its default settlement offset to T+1.

In anticipation of the North American transition to a shortened...

FIX EMEA Trading Conference – Postponed

Novel coronavirus – update for the EMEA Trading Conference 2020

Update as of Monday 9th March

Good evening

It is with extreme regret that the Board and...

FILS 2022: Volatility is rewriting the rules on high-touch, low touch trading

Pricing data from automated trading systems is inspiring less confidence during current volatility. This uncertainty stalking the market is shifting perceptions of high touch...

Rules & Ratings: Rating agencies hit with US$49 million in SEC fines

The SEC has charged six nationally recognised statistical rating organisations (NRSROs) with failures to maintain and preserve electronic communications. In total, more than US$49...

MarketAxess buys Deutsche Börse’s regulatory reporting business

Fixed income market operators and data provider, MarketAxess, has entered agreed to buy the Regulatory Reporting Hub, the regulatory reporting business of Deutsche Börse...

Trumid sees ‘record’ trade volumes in January

Bond market operator, Trumid, reported record trade volume and user participation in January 2024, claiming average daily volume (ADV) of US$6.4 billion, up 90%...

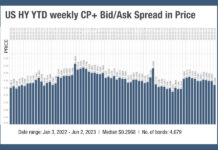

Feeling the credit crunch in high yield trading

Trading costs for high yield bonds have been elevated on both sides of the Atlantic. The US saw a big jump in bid-ask spreads...

French treasuries saw widest YtD median bid/ask spread following election

Following French president Emmanuel Macron’s unexpected snap parliamentary election on 9 June, the median bid/ask spread in French treasury bonds was at its widest...

Lipper: Bond funds come roaring back (with Fed’s help)

Refinitiv Lipper has seen a bounce back for bond funds in Q2 2020 after they suffered losses of -4.3% and outflows of US$208.9 billion...