FILS USA 2023: Finding efficiency in fixed income trading

Market operators seek to expand reach of surprisingly resilient automation.

Fixed income trading has become much more efficient over the years, driven by new technologies...

Eric Morrow joins Apollo Global Management

Eric Morrow has been named chief operations officer (COO) of trading at Apollo Global Management, an asset manager with US$550 billion of assets under...

Exclusive: Kirstie MacGillivray named UK CEO of Aegon AM

Kirstie MacGillivray has become the UK CEO of Aegon Asset Management, a buy-side firm with €315 billion assets under management. MacGillivray has been the...

Euro credit primary market “extremely dynamic” in August: AXA IM

The Euro IG corporate index spread finished August 84bps over asw – higher than levels seen at the end of July. Euro credit is...

Chinese corporates on agenda for Bloomberg Barclays Global Aggregate Index

Corporate bond inclusion is going to be on the agenda for this year's Index Advisory Council, Bloomberg has confirmed, following the inclusion of Chinese...

ICE Bonds builds on corporate bond volume records

ICE Bonds has introduced price improvement volume clearing (PIVC) to its risk matching auction (RMA) corporate bonds protocol.

RMA executes dealer-to-dealer sweep auctions, matching buyers...

LMA calls for simplified template for securitisations

The Loan Market Association (LMA) has outlined its position on securitisation disclosure templates, calling for a simplified template for private securitisations in the short-term,...

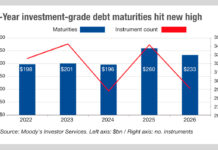

Trouble ahead for traders as number of issued bonds climbs

According to data from Moody’s Investor Services, the US investment-grade companies should have few problems refunding their debt in 2022, which is useful given...

MeTheMoneyShow : The ‘special’ relationship tested by derivatives trading

In this podcast Dan Barnes discusses with Lynn Strongin Dodds the UK’s overtures to the US in getting access to securities and derivatives trading;...

Scotiabank, Rabo Securities and Huntington Capital Markets join DirectBooks

DirectBooks, the capital markets consortium founded to optimise the bond issuance process has signed up Scotiabank, Rabo Securities and Huntington Capital Markets to join...

Dave Antonelli Joins IMTC from BlackRock

Fixed income technology provider IMTC has appointed Dave Antonelli as a strategic account executive within its sales team.

Antonelli has more than two decades of...

Euronext and UBS partnership boosts bond liquidity access

Expanding the liquidity pool through partnership creates a wider net of counterparties to benefit buy and sell-side.

Euronext has launched its Liquidity Distributor Initiative, with...