Utility mooted to reduce data onboarding friction

While data has become more abundant across the fixed income ecosystem, making it useful remains a major challenge.

“Some of our desks manage hundreds of...

FILS 2022: Meeting in the eye of tempestuous markets

The Fixed Income Leaders’ Summit is convening in Nice in the midst of a turbulent market, driven by a combination of rampant inflation, government...

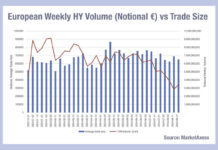

The effect of trade sizes on high yield liquidity costs

Trading in high yield markets across the Atlantic is diverging considerably, with average trade sizes and bid-ask spreads tracking quite different patterns, according to...

ICE Data Services: Bond defaults double in Q2

ICE Data Services has seen the level of defaults for bonds double in Q2 2019 to US$7.183 billion, up from US$2.616 billion in Q1...

Vis Nayar named global CIO equities at HSBC AM

Vis Nayar has been promoted to global chief investment officer for equities at HSBC Global Asset Management.

Having started his career at KPMG, he...

Ex-RBC director joins ItauBBA emerging markets team

Conor Hails has joined the emerging markets rates and foreign exchange sales team at ItauBBA. He is based in New York.

ItauBBA, part of the...

AFME welcomes ESMA ‘call for evidence’ on shortening settlement cycles

In response to a ‘call for evidence’ on shortening settlement cycles in the European Union (EU), published by the European Securities and Markets Authority...

Adaptive: The Modernization Mandate – Who Calls the Shots on Trading Tech?

The Modernization Mandate: Who Calls the Shots on Trading Tech?

Capital markets are at a critical inflection point, with firms navigating a complex transition from...

Lloyds Bank joins Neptune

Lloyds Bank has joined Neptune Networks' bond dealer community.

Neptune delivers axe data from 32 dealers in global Fixed Income to over 90 buy-side...

SEC proposes new central clearing rules for US Treasury market

US market regulator, the Securities and Exchange Commission (SEC) has proposed rule changes to enhance risk management practices for central counterparties in the US...

When banks go bust holding boring bonds

**This article will appear in full in the next issue of The DESK**

Government bonds are described as a 'risk-free' instrument, on the basis that...

BGC CEO to divest ownership if appointed US Secretary of Commerce

Howard Lutnick, CEO of interdealer broker, infrastructure and data provider, BGC Group, has said he would leave the business entirely if he is appointed...