Tipping Point: CME’s SOFR-linked STIR Futures eclipse Libor-linked STIR Futures for first time

CME open interest data confirms that Secured Overnight Financing Rate (SOFR)-linked short term interest rate (STIR) Futures open interest has, for the first time,...

Investor Demand: China expands mainland investor access to Southbound Bond Connect

China has taken measures to expand eligibility and volumes on the Southbound Bond Connect programme as it seeks to open up its bond market,...

FCA flags gaps in algo governance, testing and surveillance

A new FCA review of algorithmic trading firms has found improvements since 2018. While governance frameworks have matured, the FCA urged closer alignment with...

EU begins NGEU bill auctions but secondary market needs support

The European Union’s new bond issuance auction programme started on 15 September, via the TELSAT auction system operated by Banque de France for its...

This Week from Trader TV: Orlando Gemes, Fourier Asset Management

Targeting mispriced volatility in credit and equities.

Orlando Gemes discusses Fourier Asset Management LLC/LLP data-driven, systematic trading approach designed to uncover mispricing between credit and...

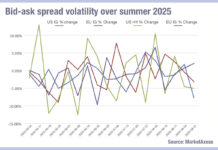

Price volatility in credit

We saw a big drop in average bid-ask spreads (>7%) for US investment grade (IG) last week, possibly a response to the massive levels...

Goldman Sachs hit 12-year record for Global Markets in 2021

Goldman Sachs has seen its Global Markets division generate net revenues of US$22.08 billion, the highest annual net revenues in 12 years, which the...

Corentine Poilvet-Clédière appointed CEO of LCH SA

LCH Group has named Corentine Poilvet-Clédière as CEO of LCH SA, the European counterparty clearing house (CCP) based in Paris, effective 1 October 2023.

Poilvet-Clédière...

TransFICC: Q&A with Steve Toland & Judd Gaddie

TransFICC has just launched a new eTrading service which combines a hosted desktop GUI with IRS venue and workflow integration, pricer API, server hosting and...

Neptune priced at £16k a year for buy side

Neptune, the dealer axe and inventory messaging platform for corporate bonds, began to charge buy-side traders a flat annual rate of £16,000 a year...

Ediphy expands API offering

Ediphy has launched a series of new trading and analytics APIs on its developer portal.

The three APIs cover execution management, liquidity checking and transaction...

This Week from Trader TV: Bryn Jones, Rathbones

From TINA to TANIA: Rathbone’s Bryn Jones on Credit Market Shifts and the Rise of Passive

As summer has drawn to a close, Bryn Jones,...