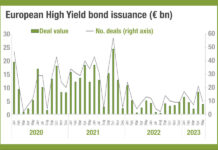

High yield issuance may bounce back

The data for Q1 bond issuance in European high yield (HY) markets shows that it fell 22.7% according to the Association for Financial Markets...

EWIFA Crystal Ladder Winner: Amber Wright

European Women in Finance, Crystal Ladder winner Amber Wright, is Global Head of Fixed Income & E-Trading at RJ O’Brien and discusses maths, efficiency...

Ilane Attias joins Citadel Securities

Citadel Securities has appointed Ilane Attias as head of continental Europe rates sales.

Attias was previously a managing director at Bank of America Merrill Lynch...

Investor Demand: Aized Rabbani joins First Eagle Investments direct lending team

Expanding its direct lending origination team, First Eagle Investments has appointed Aized Rabbani as managing director of origination. Vice president Aaron Kirsch has moved...

FINRA publishes annual regulatory oversight report

FINRA has published its Annual Regulatory Oversight Report, providing member firms with insights and observations to help strengthen their compliance programmes. New topics covered...

Plenary: Tips to be the best trading desk

A sophisticated analysis of trading impact, total cost and the market ecosystem is imperative to the success of a buy-side fixed income trading desk, said...

IRD traders see room for improvement in dealer technology use

Close to a third of interest-rate derivatives (IRD) traders are content with the technology use of their dealers, according to a recent Coalition Greenwich...

Absorbing Gilt

The year after next, the UK is set to issue £305 billion gilts to support the government’s spending programme. The high level of issuance...

Beyond Liquidity: The Promised Land

Primary bond market technology has delivered a steady stream of notable enhancements in recent years, with a small number of platforms and niche service...

FILS 2022: Itaú selects Genesis Global for new trade automation

Genesis Global, the low-code application development platform for financial markets organisations, will provide a new trade automation and client portal system for Itaú Securities.

The...

EUREX: Why credit index futures are here to stay

Lee Bartholomew, global head of fixed income and currencies product design, and Davide Masi, fixed income ETD product design at Eurex spoke to The DESK...

Five lessons from the closure of LSEG’s CurveGlobal

CurveGlobal, the interest rates derivatives market launched in 2016, is to run down its business before closing on Friday 28 January 2022, according to...