JP Morgan strides ahead in bond market-making revenues for Q1

JP Morgan saw robust fixed income revenue in Q1 2024 across US market makers, reporting US$5.2 billion over the first three months of the...

Eurex launches the first futures on a Euro High Yield Index

From 17 October 2022, Eurex will offer market participants the opportunity to hedge the Euro-denominated high-yield corporate bond market in Europe.

This segment has been...

Algomi: The two-pronged attack plan

Algomi has an idea almost universally agree to be good, yet it has struggled to get it adopted. It aggregates inventory data pre-trade, in...

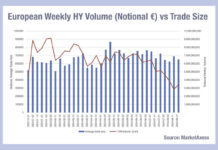

The effect of trade sizes on high yield liquidity costs

Trading in high yield markets across the Atlantic is diverging considerably, with average trade sizes and bid-ask spreads tracking quite different patterns, according to...

Cowen boosts fixed income outsourced trading team with two hires

Cowen has expanded its fixed income outsourced trading team with two senior hires, Vincent Governara and Chris Taliercio. Both traders bring over 15 years’...

Electronification of US credit delivers resilience

The electronification of the US corporate bond markets has demonstrated that its improved efficiency has strengthened depth of liquidity provision, rather than made it...

Rules & Ratings: UnitedHealth Group credit outlooks downgraded to negative

AM Best has reassigned UnitedHealth Group’s credit ratings outlooks from stable to negative in anticipation of poor 2025 performance in its Medicare Advantage segment.

Similar...

Axess All Prints: Real-time trade-level transparency for EU & UK markets

MarketAxess reveals how it has enhanced its original EU & UK trade tape, Axess All, to deliver a new level of transparency for clients and...

Mosaic Smart Data appoints Oxford Professor as Scientific Advisor

Rama Cont, Professor of Mathematical Finance, joins as Scientific Advisor

London, June 2019: Mosaic Smart Data (Mosaic), the real-time capital markets data analytics company, has...

PMs say treat LLMs like interns while vendors build on it

At the Fixed Income Leaders Summit (FILS) in Amsterdam, artificial intelligence (AIs) and large language models (LLMs) were referenced in most panels but two...

US shutdown hitting bond market traders

By Pia Hecher.

The ongoing United States federal government shutdown is directly impacting US bond market regulation and evolution, leading to the Fixed Income Market...

Groupe BPCE receives first Euronext European Defence Bond label

Groupe BPCE has issued a €750 million senior unsecured five-year bond, the first to be assigned the Euronext European Defence Bond label.

Proceeds will be...