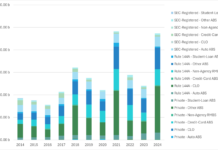

Insights & Analysis: SEC new datasets show 2024 was a boom year for ABS

New regulatory data published by the Securities and Exchange Commission’s (SEC) Division of Economic and Risk Analysis shows US asset-backed securities issuance almost doubling...

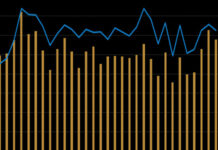

Tradeweb, Trumid close in on MarketAxess’ lunch

Electronic credit closed 2024 on a strong showing with December monthly volume growing 14.7% to US$18.3 billion year–on–year (YoY) while full-year trading volume totalled...

Get US high yield portfolios in order over summer

June looked decidedly challenging for US high yield (HY) trading, as mean bid-ask (BA) spreads dislocated from the median, indicating spikes in BA spreads...

SEC classifies HFT liquidity providers as “dealers”

US markets regulator, the Securities and Exchange Commission (SEC), has adopted two rules that require market participants who engage in certain dealer roles, in...

TMPG: Better US Treasuries data needed for effective policy

The New York Federal Reserve’s Treasury Market Practices Group (TMPG) has published a white paper on ‘Data Availability and Transparency in the US Treasury...

The elasticity of the bond market as Citadel accelerates competition

Bond markets have proven highly resilient in 2025 whilst demonstrating a significant level of adaptation across different ways of trading.

Kicking off the US Fixed...

Criticism of price formation in Gilt syndication defended by UK’s Debt Management Office

Challenges to the process of UK government bond (Gilt) pricing by syndicate banks, made by member of parliament, Mel Stride, chair of the Treasury...

Broadway upgrades Duration Trader algo to tackle rates volatility

Broadway, the front-office system provider, has upgraded its Duration Trader algorithm in an effort to meet customer and market needs during an ongoing period...

Joseph Parascandolo swaps Equilend for Wematch

Wematch.live has appointed Joseph Parascandolo as director of securities lending sales and coverage for North America, based in New York.

Parascandolo has more than 20...

The Book: Digital Asset and Euroclear tokenise gilts and Eurobonds

Digital Asset, a blockchain system provider, has completed a collaborative initiative to tokenise gilts and Eurobonds.

Euroclear, The World Gold Council, and global law firm...

Volatility, velocity and variability

Brad Levy, chief executive of Symphony, is positioning the company to help the financial industry navigate a ‘supercycle’ of change driven by the “three...

TT International picks Jean-Charles Sambor to lead EM debt team

TT International has appointed Jean-Charles Sambor as head of its emerging markets debt division. The group will run EM debt strategies across sovereign and...