This Week from Trader TV: Gregory Corrigan, L&G Asset Management

L&G AM: Record volumes, retail surge, and new venues shape US equity markets.

This year, US equity markets have been shaped by record trading volumes,...

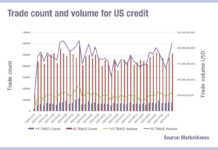

Trade size disparity in US credit speaks volumes about balance sheet

Analysis of trading activity in the US corporate bond market shows that investment grade (IG) bonds are seeing greater moves towards larger order sizes...

ICE: Creating clarity in the MBS market through better data

The highly fragmented nature of mortgage asset components has historically translated into a lack of granular data for investors. Intercontinental Exchange (ICE) aims to...

Joel Kim of Dimensional Fund Advisors on corporate bond liquidity

With Joel Kim, Head of International Fixed Income and CEO Asia ex-Japan, Dimensional Fund Advisors.

Briefly describe Dimensional Fund Advisors, including its fixed income trading...

Origination: State Street issues US$2.25 billion in senior debt

State Street has issued US$2.25 billion in senior debt through State Street Bank and Trust. The bank has partnered with diverse and veteran-owned firms...

StoneX launches loan market liquidity platform

StoneX Group has launched StoneX LoanMatch, an online platform designed to improve liquidity access for institutional clients and banks in the loan market.

The platform...

FCA tells asset managers to focus on liquidity risk after finding some firms lacking

The UK’s Financial Conduct Authority (FCA) has told asset managers to increase their focus on liquidity risk, stating gaps in liquidity management could lead...

Trumid announces record platform activity in January

Bond market operator, Trumid, has reported a record month of activity in January 2020 on Trumid Market Center, the company’s electronic bond trading platform....

Why traders make better PMs

A new paper published by Gjergji Cici of the University of Kansas, with Philipp Schuster and Franziska Weishaupt, of the University of Stuttgart, has...

Insights & Analysis: Market participants must prepare for the unexpected, ESAs say

Despite a broadly positive environment, ongoing geopolitical developments and economic uncertainties mean that financial market participants should be more vigilant than ever, according to...

The right way to trade credit

Of course, there is no right way to trade all credit, but there are clearly advantages in trading credit in such a way that...

SMBC joins DirectBooks

DirectBooks, the capital markets consortium founded to make bond issuance more efficient, has seen SMBC Nikko Securities America, a member of SMBC Group, join...