Fixed income: The unexpected consequences of change

By Mark Goodman, Managing Director, Global Head of Electronic Execution – FX, Rates, Credit & Futures at UBS Investment Bank.

Our age’s fascination with technology...

Axess All Prints: Real-time trade-level transparency for EU & UK markets

MarketAxess reveals how it has enhanced its original EU & UK trade tape, Axess All, to deliver a new level of transparency for clients and...

US president to oversee financial institution regulation amid deregulation drive

New executive orders signed by US president, Donald Trump, have given him oversight of all US financial regulation, outside of monetary policy, while also...

Joseph Stewart named co-head fixed income at SocGen US

Joseph Stewart has started a new position as managing director, co-head of fixed income division for the Americas and head of flow sales for...

Tradeweb talks up futures market; reports Q1 growth, LSEG confusion

Tradeweb, a subsidiary of London Stock Exchange Group (LSEG), saw continued outperformance in fixed income markets in the first quarter (Q1) of 2024.

Tradeweb’s...

Digitization has changed EGB trading forever

Digitization has changed EGB trading forever

Roderick Joniaux, European Government Bonds (EGB) Product Manager, Tradeweb

Many of us have witnessed first-hand how new technologies have impacted financial...

The Agency Broker Hub: How agency brokers are shedding their skin

By Umberto Menconi, head of Digital Markets Structures, Market Hub, Intesa Sanpaolo Group*

The agency broker has always played one of the principal roles on the...

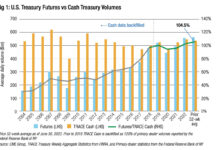

FILS in Barcelona: If the future is futures, what happens when the market is...

Moving liquidity from the spot or cash markets into futures is raising some concern amongst market participants. In FX, trading volume on the Thomson...

Bloomberg backs Moroccan FX and govie market buildouts

The central bank of Morocco, Bank Al-Maghrib, has adopted Bloomberg’s Foreign Exchange Electronic Trading (FXGO) and E-bond (EBND) platforms.

The interbank derivatives market for foreign...

A tale of two metrics – US IG corporate bond market liquidity in 2022

By Julien Alexandre, 12 October 2022

Corporate Bond Market Distress Index

The NY Fed recently launched the Corporate Bond Market Distress Index and backfilled it all...

The big shocks hitting portfolios in 2022

Portfolio managers have some very large events to consider, along with many more nuanced side-effects.

At the beginning of the year, rising inflation and interest...

NNIP sees three areas of opportunity under moderate rate rise

By Flora McFarlane.

With the Fed expected to announce a third interest rate hike in December, and European counterparts likely to follow suit, investors have...