European Markets Choice Awards 2022 – The Winners

Last night, Markets Media held its first in person European Markets Choice Awards event in London to celebrate the accomplishment of everyone who works...

Charles River and LedgerEdge collaborate on DLT-enabled credit liquidity and trading services

Charles River Development, a State Street Company, is collaborating with distributed ledger bond market specialist LedgerEdge, to provide investment firms with access to corporate...

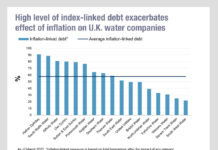

Examining the (Thames) Water fall

In 2013 when markets still looked precarious amid the fallout from the financial crisis, utilities were a good investment.

With a near cast-iron cashflow...

Subscriber

Bloomberg Terminal releases document search and analysis feature

Bloomberg is expanding the artificial intelligence capabilities of the Bloomberg Terminal with a document search and analysis solution.

The new service is expected to allow...

BNP Paribas streamlines pre-trade client workflow with ipushpull

BNP Paribas is streamlining its manual workflow for non-standard, complex trades, to support its global asset manager client base.

Using technology developed by ipushpull, a...

European bond traders struggle with block trades and counterparties

Analysis of the European and US corporate bond markets by Coalition Greenwich has found that block trades and counterparties are a far greater concern...

Ediphy launches automated bond liquidity discovery tool

Fixed income technology provider Ediphy has launched a tool, Liquidity Checker, which allows fixed income market participants to automate the monitoring of bond liquidity....

Iulia Nastasoiu joins Mizuho

Iulia Nastasoiu has joined Mizuho as a vice president in the European Treasury division. She is based in London.

Nastasoiu has close to 15 years...

UK proposes streamlined listing regime, confirms consolidated tape for bonds

UK market regulator, the Financial Conduct Authority (FCA), has set out proposals aimed at making the UK’s listing regime more “accessible, effective, and competitive.”

In...

BestEx Research launches no-code algo trading tool

BestEx Research Group, a provider of algorithmic execution and measurement solutions for equities, futures, and FX trading, has added a no-code algorithmic trading tool,...

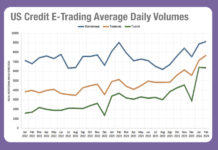

Exclusive: Analysing the battle for US e-Trading in February

The highly competitive corporate bond market saw average daily volumes converge in the US across electronic trading venues in February. The DESK has exclusively...

The DESK’s Trading Intentions Survey 2020 : Streamed dealer prices

STREAMED DEALER PRICES.

Streaming prices from dealers provide a key perspective on the market, but unless they are executable they have limited value for trading....

Subscriber