Oppenheimer veteran joins Dinosaur Financial

Dinosaur Financial Group has appointed Robert Rahman as global head of credit within its newly-launched global corporate credit securities (GCCS) division.

GCCS aims to be...

Reports indicate UBS Bond Port is on a tear

Several buy-side traders have reported they are seeing significantly increased volumes and buy-side activity on the UBS Bond Port platform in the second quarter...

FILS USA: The roadblocks to electronic fixed income trading

Fixed income markets moving toward electronic trading has been a recurring theme in the industry for a number of year, but there are roadblocks...

Exclusive: ICE relaunches enhanced sweeps session-based protocol, ICE RMA

Intercontinental Exchange, (ICE), has relaunched ICE Risk Matching Auction (RMA), an enhanced sweeps session-based protocol for dealer-to-dealer fixed income trading, which ICE president Peter...

Illiquidity creeps up in US credit… will e-trading save the day?

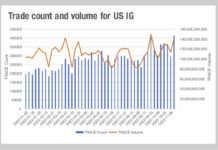

Looking at data on US credit markets, taken from MarketAxess Trax, which tracks trading across multiple markets and counterparties, investment grade trading volumes have been...

CME’s US corporate bond index futures to launch 17 June

CME Group has revealed that its new credit futures are scheduled to begin trading on 17 June 2024, pending regulatory review.

Launching alongside the company's...

Banque de France and Euroclear plan short-term French debt tokenisation

Banque de France and Euroclear have launched Pythagore, a joint project for the tokenisation of Negotiable European Commercial Paper (NEU CP).

The project aims to...

BayernInvest taps Bloomberg for integrated asset management workflow offering

BayernInvest, a German asset manager with approximately €88 billion assets under control, has adopted an integrated suite of Bloomberg solutions to support its front-to-back...

MarketAxess’s 2020 revenues up nearly 35%

Electronic bond market operator, MarketAxess, has reported revenues in 2020 were up 34.8% on 2019 to US$689.1 million, compared to US$511.4 million for the...

RBC names Michael Mullholland director of leveraged credit sales

RBC has named Michael Mulholland director of leveraged credit sales, based in London.

Mulholland joins from UBS, where he was part of the firm’s leveraged...

Bond Origination Technologies set to launch early 2021

Bond Origination Technologies (Bots), a London-based financial technology start-up for the primary debt capital markets (DCM), has completed its latest fundraising round, formed its...

Duff leads UK debt, EMEA FIG at SMBC

Matthew Duff has been named head of the EMEA financial investment group and UK debt syndicate at SMBC Group. He is based in London.

SMBC...