KNG names Omar Ghalloudi head of emerging market trading

KNG Securities has appointed former Credit Suisse illiquid bond specialist Omar Ghalloudi as head of emerging market (EM) trading.

Corporate and distressed bond ‘expert’ Ghalloudi...

MeTheMoneyShow – Episode 19

Dan Barnes speaks with Lynn StronginDodds about the shifting European exchange landscape.

Me The Money Show Episode 19 from Markets Media on Vimeo.

©Best Execution &...

Shape the way you access The DESK in 2025

In 2025 we will be introducing proprietary data tools to allow our readers to research bond issuers and issuance activity.

To support our independent sourcing...

PGIM: Research indicates liquidity event is tail risk with greatest impact

In a survey of 400 senior investment decision-makers at institutional investors in Australia, China, Germany, Japan, the UK and the US with a combined...

Trumid sees ‘record’ trade volumes in January

Bond market operator, Trumid, reported record trade volume and user participation in January 2024, claiming average daily volume (ADV) of US$6.4 billion, up 90%...

US electronic credit trading slows down in May

Average daily TRACE volume for US investment grade (IG) and high yield (HY) corporates slipped 10.8% from April to US$52.8 billion, according to MarketAxess...

The Book: Alphabet tops issuer league table in May

Alphabet Inc., the parent company of Google, was the largest corporate issuer in May 2025. It issued a combined US$5 billion and a combined...

Frans de Wit is new head of trading at PGGM

Frans de Wit, the investment director for Treasury, Trading & Commodities at Dutch pension fund manager PGGM, has been named head of trading, following...

Matthew Walters joins Susquehanna

Susquehanna has appointed Matthew Walters as head of credit platform sales, a source has revealed to The DESK. He reports to Justin Lada, head...

SocGen’s Sogecap issues €800 mil in perpetual notes

Societe Generale’s life insurance company Sogecap has issued €800 million in restricted Tier 1 perpetual notes.

Perpetual notes have no maturity date, and are non-redeemable....

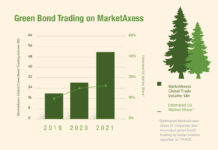

Trading for Trees

In 2019 MarketAxess launched their “Trading for Trees” program, under which five trees are planted by One Tree Planted, a partner charitable organization, for...

BondbloX to offer US corporate, muni and Treasury bond liquidity

BondbloX Bond Exchange (BBX), the world’s first fractional bond exchange, has integrated with ICE Bonds to offer US corporate, municipal and treasury bond liquidity...