QE: A rush for the exit

Fixed income portfolios need to be reassessed in preparation for the end of asset purchasing programmes. Dan Barnes reports.

Quantitative easing has wound up an...

US banks boosted trading assets ahead of new lenient stress test results

Easier 2025 stress test assumptions and friendlier accumulated other comprehensive income (AOCI) treatment have freed capital for American investment banks’ fixed income desks; US...

EWIFA: Breaking the glass ceiling

It is almost time for this year’s European Women in Finance Awards, and we at Markets Media are looking forward to seeing 2024’s nominees...

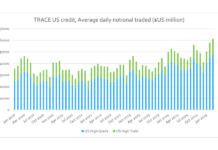

US credit trading reached record highs pre-tariffs

The corporate bond market was already at record levels before the US tariffs came into force, FINRA data shows.

US credit trading volumes reached record...

Handelsbanken Fonder AB adopts Bloomberg’s PORT Enterprise

Handelsbanken Fonder AB, a subsidiary of Handelsbanken managing approximately 100 mutual funds, has adopted PORT Enterprise, Bloomberg’s portfolio and risk analytics solution, to further...

European credit volumes plummet as US stays buoyant

European corporate bond markets have seen trading volumes and trade count collapse going into summer, as the holiday period provides some respite for tired...

Top trends in fixed income electronification for 2018

By Flora McFarlane.

Analyst firm Aite Group has predicted six electronification trends for fixed income in 2018, highlighting further room for expansion for fintech firms,...

Green bond issuance off to strong start in 2021

As a result of the stronger-than-expected green bond issuance so far in 2021, NN Investment partners has raised its projection for full-year issuance to...

‘HUB’ approach to buy-side middle and back office unites rivals

A new technology-led company, HUB, is being formed to build a cloud-based operating platform aimed at transforming asset managers’ operations technology.

The firm is being...

JWG: Cloud is “large systemic technology risk blind spot”

JWG, the regulatory think tank, has published a research paper ‘Risk control for a digitized financial sector’ which claims to identify a large systemic...

ICE consolidates access to ICE Bonds and ICE Data Services

Market operator Intercontinental Exchange (ICE), has launched ‘ICE Select’ an application which provides connectivity to the ICE Fixed Income ecosystem, including the ICE Bonds...

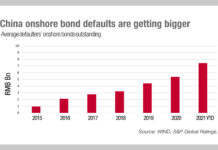

China focus: The outstanding debt of defaulters

Concern around issuer defaults in China is clearly based upon good evidence; our chart this week from S&P Global Ratings shows the annual growth...