US dealer exposure to interest rate risk in their investment grade (IG) bond inventories hit its lowest level for twelve months in week of 2 July 2025, based on research from Bank of America (BofA), despite fluctuations in the overall level of inventory holdings. IG dealer inventories were estimated to have declined by US$684m on 10 July 2025.

BofA analysis has assessed the Dollar Value of an 01 (DV01) measure for primary dealer inventories, which tracks price sensitivity of bonds held to a basis point change in yield, based on New York Bank of the Federal Reserve (Fed) data from its primary dealer survey.

DV01 levels have been largely negative since September 2024, implying that banks have successfully maintained lower exposure to interest rate risk over the past year, with an exceptional spike in April 2025, the period of the Trump Administration’s ‘Liberation Day’ tariffs.

To some extent their management or risk has correlated with changes in the levels of their IG inventories. However, since May 2025, they have been cutting IR risk exposure while their inventories have been in positive to neutral territory. This implies they have been increasing their holdings of shorter-dated instruments which have lower interest rate exposure.

In part this may be a response to issuers, who perceive a likely drop in rates in the near future, and therefore want to manage their refinancing costs by limiting longer term exposure to higher rates.

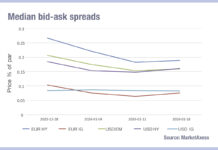

Looking at the US dealer revenues in secondary markets for fixed income, currency and commodities (FICC) over the past quarter, it is clear from the double digit increases (year-on-year) posted by Bank of America, Citi and JP Morgan, and the 9% YoY posted by Goldman Sachs and Morgan Stanley with positive notes on their credit businesses, that they are delivering strong growth for their overall businesses, while also managing risk effectively and delivering competitive liquidity to their buy-side clients.

Although the level of competition between market makers in corporate bond trading has been fierce over the past two years, and evolution on the dealer side has not been entirely consistent, we are now building a picture of dealer activity that is increasingly positive.

Dealers are managing inventories well, they are managing risk effectively to reduce the potential costs of associated risk, and they are doing so while delivering strong revenues.

This sets up credit dealers well for the second half of the year, as they continue to face-off against a thriving rivalry with electronic liquidity providers.

©Markets Media Europe 2025