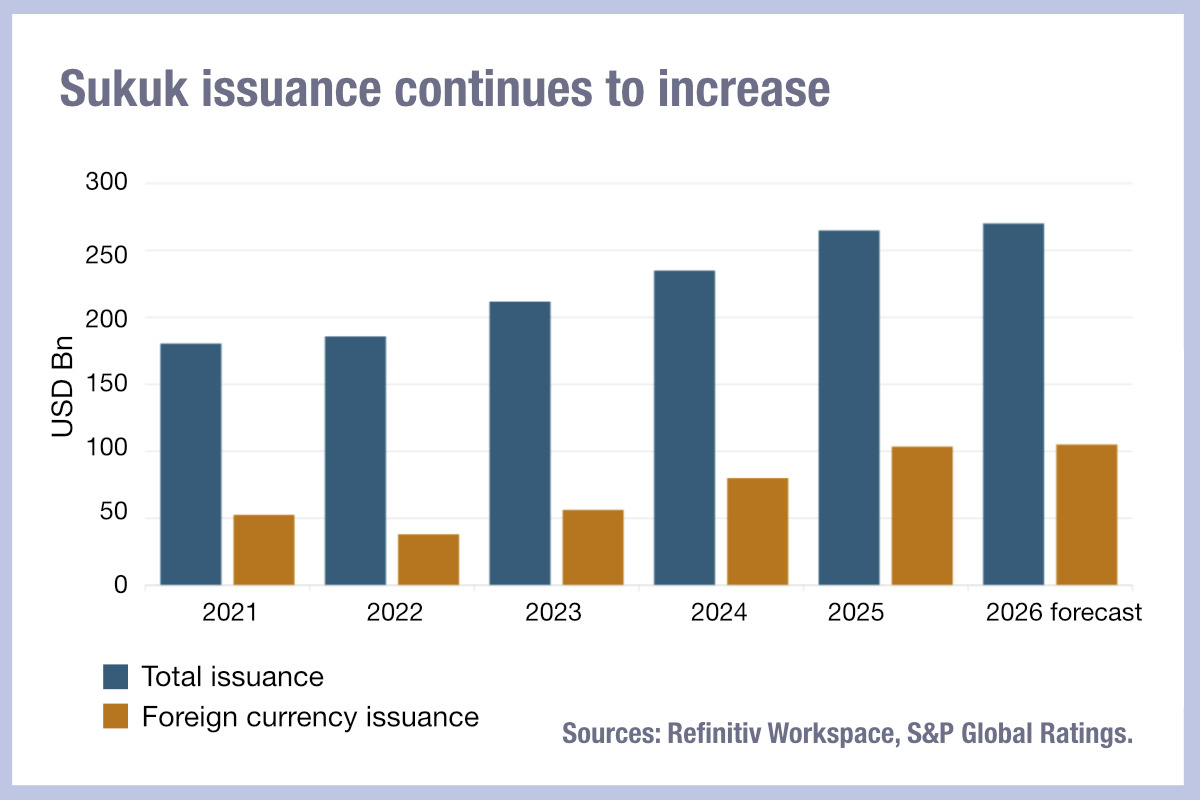

S&P Global has reported that global sukuk issuance hit US$264.8 billion in 2025, up from $234.9 billion in 2024, driven by solid economic growth in major Islamic finance countries, with high financing needs and supportive financing conditions underpinned by globally declining interest rates. As The DESK has reported previously, the Middle East has seen a corresponding growth of electronic trading, with MarketAxess noting a 23% increase in MENA corporate bond trading volumes.

S&P Global wrote, “The figures are higher than S&P Global Ratings’ historical figures as we are now using a broader measure of local currency denominated sukuk issuance. Foreign currency denominated issuances exceeded US$100 billion in 2025, almost double the volume in 2021. Issuance was concentrated in a few countries–particularly those in the Gulf Cooperation Council and in Malaysia–reflecting activity in the broader Islamic finance industry, but we have observed some interest from non-traditional issuers.”

S&P Global wrote, “The figures are higher than S&P Global Ratings’ historical figures as we are now using a broader measure of local currency denominated sukuk issuance. Foreign currency denominated issuances exceeded US$100 billion in 2025, almost double the volume in 2021. Issuance was concentrated in a few countries–particularly those in the Gulf Cooperation Council and in Malaysia–reflecting activity in the broader Islamic finance industry, but we have observed some interest from non-traditional issuers.”

Looking ahead, the firms says that it expects 2026 issuance to continue growing, albeit with notes that the risks of volatility in global capital markets and spikes in geopolitical risk could be a barrier.

“We expect issuance to continue increasing, supported by lower oil prices, strong economic performance in some core Islamic finance countries’ economies, particularly Saudi Arabia and the UAE, and supportive market conditions. Our forecast average brent oil price of $60 for 2026 adds revenues-side fiscal pressure in some oil-dependent Islamic finance countries, which, notwithstanding expected production increases, could add to nominal funding requirements, which we expect will be partially met through sukuk issuance. We also expect the market to benefit from lower rates due to a forecast 50 basis points (bps) rate cut by the Federal Reserve in the second half of 2026. We are also keeping an eye on a potential revision of the Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI) Standard 62, but do not expect it to affect sukuk issuance in 2026.”

©Markets Media Europe 2025