Tag: Coalition Greenwich

Voice trading remains prevalent in Treasury trading

Citadel Securities is conducting a third of its Treasury risk by voice, according to a representative. Kevin McPartland, head of research, market structure and...

Opinion: Competition, not regulation, will make better bond markets

European credit trading has historically seen levels of electronic trading of around 50% of total corporate credit trading, while the US market has historically...

‘Today’s inefficient is yesterday’s efficient’: Innovation in corporate bond issuance

While nearly half (47%) of corporate bond investors feel that technology has made the new issue process more efficient, the mechanics of distributing newly...

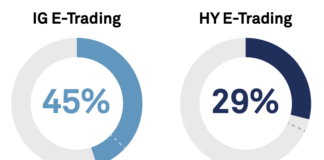

Analysis: Electronic trading across US and European bond markets

Electronic trading of US credit erupted in May 2024, according to analysis of the US credit market by Coalition Greenwich. It found that investment...

Subscriber

FILS USA: How all-to-all trading can break through the 17% barrier

Robert Fink, head of buy-side relationships at analyst firm Coalition Greenwich, opened a session at the Fixed Income Leaders Summit in Boston, by noting...

Coalition Greenwich: Return on investment now viable for fixed income EMS

Dated fixed income markets are set to undergo a rapid technological transformation. But it is from a low bar, with fixed income 10 to...

Subscriber

US high yield e-trading volumes drop YoY

US corporate bond activity saw a slight slowdown over March, although remained elevated on a historical basis, Coalition Greenwich’s April Data Spotlight on US...

US primary dealer bond trading hits record low

US Treasury market volatility saw a decline in March, according to Coalition Greenwich’s April Data Spotlight on US rates trading. The MOVE Index monthly...

Balancing short and long term liquidity provision

Best execution on a trade-by-trade basis is too simplistic a measure of liquidity provision; The DESK looks at best practice for longer term liquidity...

Leveraged loan market ripe for innovation after 2023 revenue bump

US dealer revenue hit US$900 million in 2023, representing a 16% increase against 2021 and a 29% bump on 2022, attributed to a renewed...