The Book: Who will drive reform in primary markets?

Primary market practices are under pressure to change, however the urgency and direction given for adaptation are often skewed by specific market participant groups.

The...

Fixed Income Automation Surge: 60% of Credit Traders Now Use Robots

The electronification of fixed income markets is accelerating, driven by increased adoption of automated trading systems, with 60 per cent of credit market participants...

Daniel Mayston leaves BlackRock

Daniel Mayston has resigned from BlackRock after nearly 20 years at the world’s largest asset manager, according to sources close to the company.

Mayston was...

Balancing short and long term liquidity provision

Best execution on a trade-by-trade basis is too simplistic a measure of liquidity provision; The DESK looks at best practice for longer term liquidity...

Coalition Greenwich: US Treasuries trading up 46% YoY in January

“The more the US government borrows (US$2.6 trillion in January), the more US Treasury traders trade.”

This activity, according to Coalition Greenwich’s Kevin McPartland, is...

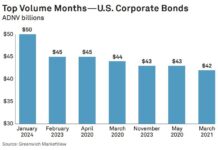

Credit: January sees largest average daily notional for US corporate bonds

January 2024 saw the largest single volume day and largest average daily notional volume (ADNV) month ever for US corporate bonds.

$75 billion of investment...

The new normal: Top 2024 market structure trends

A new report from Coalition Greenwich outlines the trends set to define markets in 2024, with insights gleaned from clients and ongoing research.

Dan Connell,...

The big changes to watch in fixed income market structure through 2024

Next year will bring new developments in market structure, stemming both from regulatory and political change. The DESK asked Jennifer Keser, head of market...

A wild ride: Tradeweb’s Hult reviews the bond market in 2023

Historic interest rate moves, a debt ceiling stalemate, major bank collapses and massive geopolitical instability. These mega events sent shocks through the markets in...

Exclusive: Stacey Parsons joins PrimaryBid

Capital markets technology firm, PrimaryBid, has appointed Stacey Parsons as managing director and head of fixed income. Parsons’ appointment is expected to accelerate PrimaryBid’s...