Balancing short and long term liquidity provision

Best execution on a trade-by-trade basis is too simplistic a measure of liquidity provision; The DESK looks at best practice for longer term liquidity...

Euroclear launches new subscription-based fixed income liquidity data service

International central securities depositary (ICSD) Euroclear has launched Euroclear LiquidityDrive, a new data service, offering in-depth liquidity analysis on all fixed income instruments settled...

ESMA consultation on RTS 2 marks accelerated process

The European Securities and Markets Authority (ESMA) has launched a consultation on the development of draft regulatory technical standards to specify the pre-trade thresholds...

The Book: Who will drive reform in primary markets?

Primary market practices are under pressure to change, however the urgency and direction given for adaptation are often skewed by specific market participant groups.

The...

Scotiabank, Rabo Securities and Huntington Capital Markets join DirectBooks

DirectBooks, the capital markets consortium founded to optimise the bond issuance process has signed up Scotiabank, Rabo Securities and Huntington Capital Markets to join...

Fixed Income Automation Surge: 60% of Credit Traders Now Use Robots

The electronification of fixed income markets is accelerating, driven by increased adoption of automated trading systems, with 60 per cent of credit market participants...

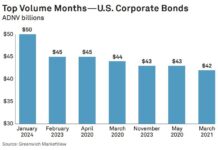

Credit: January sees largest average daily notional for US corporate bonds

January 2024 saw the largest single volume day and largest average daily notional volume (ADNV) month ever for US corporate bonds.

$75 billion of investment...

The new normal: Top 2024 market structure trends

A new report from Coalition Greenwich outlines the trends set to define markets in 2024, with insights gleaned from clients and ongoing research.

Dan Connell,...

Market structure: The alternatives in market making

The DESK profiles five of the major electronic liquidity providers.

Given the strains on market making in fixed income, it is vital that buy-side desks...

Market Structure: New risk and liquidity in the US Treasury market

Significant changes in counterparties and market structure have transformed US Treasury market activity.

Dealer-to-client trading has overtaken interdealer markets in volume traded according to analyst...