Historic interest rate moves, a debt ceiling stalemate, major bank collapses and massive geopolitical instability. These mega events sent shocks through the markets in 2023, Tradeweb CEO, Billy Hult, said in the firm’s annual client letter this year.

Despite this ’wild ride’, Hult said, markets have adapted and firms have evolved beyond just weathering the storm, developing new tools and skill sets to deal with these shocks. “Thanks to changes in behaviours and the transformative potential of AI and other innovations, the table is set for the most exciting chapter yet in the history of electronic trading,” Hult added.

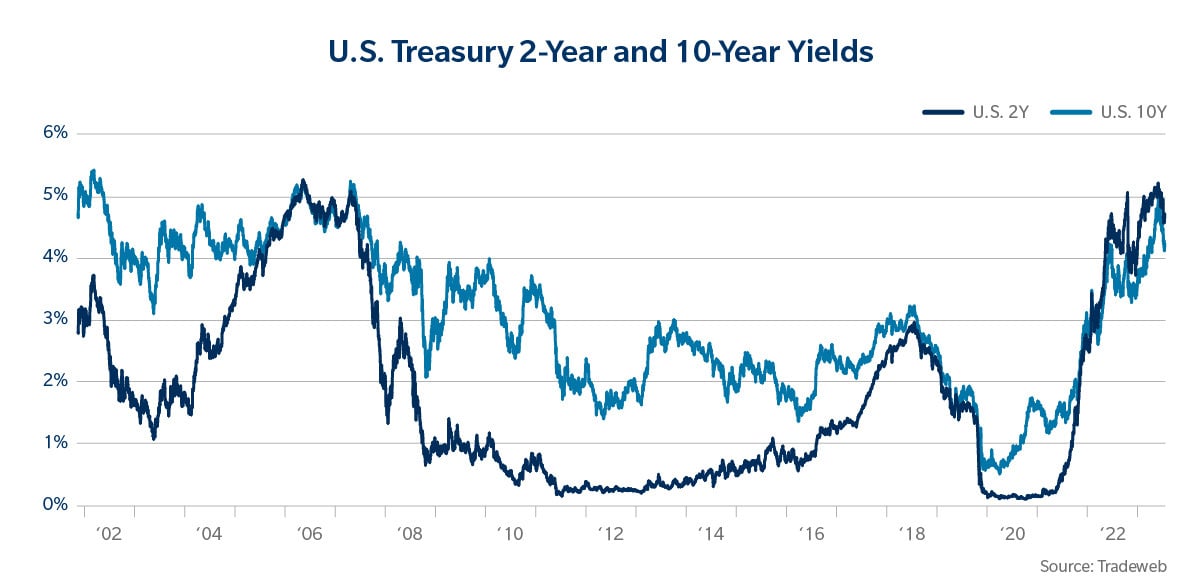

Hult said the “angst” of 2023 was reflected in fixed income sentiment, depicted in the chart below, which shows the yields on the US Treasury 2-year and 10-year notes over the last 17 years.

Following a period of historically low yields, the 2-year note moved nearly 150 basis points over the course of the year, rising from a low of 3.7% in May to a high of 5.2% in October.

Meanwhile, 10-year Treasury yields were experiencing their own 170 basis point rise, nearly touching the 5% threshold in October. Throughout, the 2-year/10-year yield curve was inverted, reflecting market participants’ persistent concerns about the likelihood of a recession.

Similar patterns played out globally, Hult said. “We saw a 101 basis point rise from this year’s trough to peak in the 10-year German Bund, a 172 basis point move in the 10-year UK Gilt and even a 70 basis point move in the notoriously stable 10-year Japanese Government Bond.”

Bond yields attractive again

Hult said one of the key takeaways from this year was that bond yields were attractive again. “Through November, we continued to see record trading volumes on our platform,” Hult said.

Average daily volume (ADV) in US government bonds was up 19.5% year-over-year (YoY), European government bond ADV was up 30.5% YoY, Japanese government bond ADV was up 31.9% (42.8% in JPY) YoY, fully electronic US credit ADV was up 32.0% YoY and European credit ADV was up 29.7% YoY.

Retail investors also gravitated toward bonds for increasingly attractive yields. “On our Tradeweb Direct platform, we saw the number of daily retail trades in some areas soar over the last year, as retail investors embraced Treasury bonds and brokered certificates of deposits,” Hult noted.

Institutional and retail investors also took advantage of the recent yield volatility to book advantageous losses through tax-loss harvesting – “an opportunity rarely available to this market given munis’ historic stability.” October sell inquiries were 65% higher than the August year-to-date average and November liquidation requests 70% above that level.

ETFs FTW

According to data from Invesco, in Europe, fixed income exchange traded funds (ETFs) saw record annual inflows over the past 12 months, with bond ETFs accounting for $63 billion of net new assets in 2023, surpassing the inflows seen in 2019.

In the first three quarters of this year, fixed income ETFs saw $51.6 billion worth of inflows, making up 49% of all ETF inflows in Europe. “We expect this trend to continue into 2024, as the heightened focus on trading costs, cross-asset expertise and expanding electronic trading offerings in corporate credit pick up steam,” Hult noted.

All this tumult of 2023, Hult said, has led to new approaches to trading and price discovery, and a “collective spirit of innovation” that has fundamentally changed market structure.

Electronic trading

For starters, the use of electronic and automated trading protocols in places where phone-based trading was once dominant. “We saw a remarkable level of ‘stickiness’ in electronic trading volumes throughout the period of extreme volatility we experienced in March, coinciding with the Silicon Valley Bank (SVB) and regional banking crises.”

Despite these banks capsizing representing some of the biggest crises to impact market confidence since 2008, the underlying infrastructure of electronic credit markets was largely unaffected. “In fact, overall trading volumes across protocols including portfolio trading, request-for-quote (RFQ) and sweep sessions held strong throughout the crisis period,” Hult noted.

“Market participants are realising that they have more options and more visibility on electronic markets during periods of volatility and they are increasingly riding out the storms on their screens.”

Future shock

Looking ahead, Hult said the trading activity of hedge funds had begun incorporating Tradeweb’s Automated Intelligent Execution (AiEX) into their systemic trading strategies.

“Rather than merely replacing existing manual workflows, AiEX is creating entirely new avenues of trading across various asset classes and trading environments,” Hult said. As hedge fund clients began to experiment with AiEX during different market conditions, they found they could deploy various trading protocols such as RFQ and RFM in a more automated fashion to maximise results.

“Businesses are investing trillions in generative AI and other technologies that will transform the way we access and process information, and market participants continue to experiment with new ways to cover more ground faster,” Hult said, looking to 2024.

The $10 trillion US corporate bond market is undergoing metamorphosis, Hult said, as the combination of electronic trading, sophisticated algorithms and ETFs is helping to boost liquidity and attract new players to the game.

Signing off, Hult said he is certain of two things: “Events that we never could have imagined, much less planned for, will occur, and ingenuity and grit will help us navigate our way through them.”

© Markets Media Europe 2023