Tag: Credit Spotlight

Decision trees (and how to climb them)

Making the working lives of credit traders better is The DESK’s mission. Traders are time poor, and systematising trading allows them to free up...

Measuring implicit costs and market impact in credit trading

Evaluating the quality of a bond trade is made complex by the multiple dynamics which impact quality, and the frequent absence of data to...

Credit: The big takeaways from FILS Europe

In a market ‘obsessed’ with yield pick up, seeing considerable inflows into bond funds, corporate debt is getting bought up en masse. While this...

Best practice in credit TCA measures

The need to optimise execution quality is increased as buy-side firms seek to optimise all-to-all trading, and therefore price making, in credit. Transaction cost...

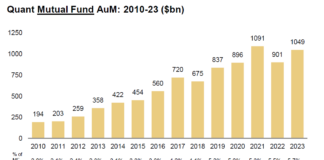

How big can systematic trading get in credit?

Investors can achieve significant advantages though systematic trading, such as reduction of trader/investor bias, and responsiveness to signals. However, there are limits to the...

Getting the most out of derivatives in credit

Bond investing has become more exciting in the past two years than in the previous ten, with interest rates and central bank activity fire-fighting...

Do regulators understand ‘best execution’ in corporate bond markets?

What is best execution in bond markets?

In fixed income a best execution process matches up trade metrics to the investment parameters.

“Trading is simply how...

What effect could retail flow have on credit markets?

Retail investment in equity markets has had two major effects on market conditions; one is an increasing engagement in direct trading into the market,...

Do banks want credit trading to look like FX?

The end game of market making commoditisation is that a smaller number of players provide a vast volume of liquidity to the majority of...