Tag: Fitch Ratings

Ratings & Analysis: AI comes for credit ratings

Credit rating agencies are facing the threat of AI, with their share prices taking a major hit this week following the release of new...

Investor Demand: Oracle balances debt issuance with equity reflecting investor caution

Oracle Corporation announced its full calendar year 2026 plan to fund the expansion of its Oracle Cloud Infrastructure business on Sunday 1 February, to...

Origination: S&P prices major senior note issuance

S&P Global has priced a total US$10 billion in senior notes.

The offering is split into US$600 million 4.250% senior notes due 15 January 2031,...

Ratings & Analysis: Fitch: US bank regulators converging with “informal alignments”

Executive actions have accelerated regulatory consolidation and centralisation between federal US bank regulators, according to Fitch Ratings.

These informal alignments, driven by executive orders rather...

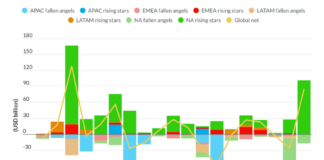

Ratings & Analysis: Fitch’s rising stars accelerate upgraded debt levels

Changing credit ratings for three North American issuers in Q3 2025 pushed upgraded debt levels above downgraded debt in its global corporate portfolio, Fitch...

Origination: Chevron issues US$5.5bn as revenue slumps

Chevron issued US$5.5 billion of notes in August after a disappointing second quarter.

The energy giant reported US$44.8 billion in revenues in Q2 2025, a...

Ratings & Analysis: First Brands Group issuer ratings plunge

Autopart supplier First Brands Group has plummeted in credit agency ratings, declaring bankruptcy in the US.

Fitch dropped the company from B to CCC last...

Rules & Ratings: France falls in Fitch’s ratings

France has suffered a blow to its credit ratings, downgraded by Fitch to AA- from A+ with a stable outlook.

A catalyst for this change...

Origination: Goldman prices US$400 million in notes

Goldman Sachs has priced US$400 million in unsecured notes, due 2030.

The notes have a 5.650% coupon and are expected to be delivered around 9...

Rules & Ratings: Delta gets a positive outlook upgrade at Fitch

Fitch Ratings has revised Delta Art Lines’ credit rating outlook from stable to positive, and affirmed its BBB- long-term Issuer Default Rating (IDR).

This change...