Tag: Gareth Coltman

Trade size growth undercuts European bond market ‘equitification’

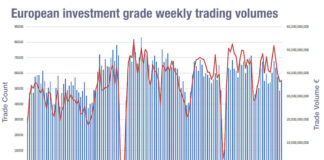

Since 2023 European corporate bond markets have seen trades size grow, as trading platforms report increasing volumes

“If we break down electronic trading growth in European...

FILS 2024: Applying AI to trading

Asset management and trading businesses are being transformed by artificial intelligence. That was the message from a series of panels at the Fixed Income...

Adaptive Auto-X creates choice in trade automation

Developing automation to suit a range of market environments has put MarketAxess’s clients ahead in the drive for more efficient trade execution and adaptable...

FILS USA 2023: Finding efficiency in fixed income trading

Market operators seek to expand reach of surprisingly resilient automation.

Fixed income trading has become much more efficient over the years, driven by new technologies...

Viewpoint: MarketAxess to increase automation with Adaptive Auto-X

MarketAxess is aiming to initially launch Adaptive Auto-X in the first half of this year to provide clients with algorithmic workflows and allow them...

Technology: Educating data

Can better pre-trade data really unlock liquidity in frozen fixed income markets?

If buy and sell-side bond traders are to see real benefits from the...

FILS 2022: Could ESMA ban RFQs?

The future of the request for quote (RFQ) protocol was being challenged both on and off stage at the Fixed Income Leaders’ Summit in...

FILS USA 2022: Boosting automation and innovation

The attention of buy-side portfolio managers and traders at the FILS conference in Nashville last week was focused on ways to better manage inefficiency...

Tangible returns from bond trade automation

Adoption of automated trading continues apace across several bond markets and within different grades of instrument. Gareth Coltman, global head of automation at MarketAxess,...

The DESK’s Trading Intentions Survey 2021 : MarketAxess

Consistently rated as the most effective platform for finding liquidity in the corporate bond market, MarketAxess has frequently been ahead of the market in...

Subscriber