Tag: Jane Street

Signalling risk in credit, if one counterparty is 50% volume

How do you avoid information leakage? Does this change if half the market is trading with a single counterparty? Knowing that electronic market maker,...

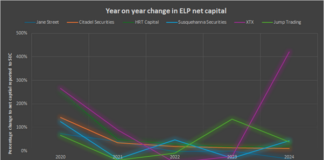

Risk profiling electronic market makers after Jane Street, Jump re-rated

Last year, Jane Street and Jump Trading had their rating outlooks upgraded by ratings agencies, as they overcame potential hurdles facing their businesses. Electronic...

Jane Street: Ten years of progress

The DESK and Jane Street first met in 2014 at FILS – we speak with Ian Shea, Head of Fixed Income Trading.

How has...

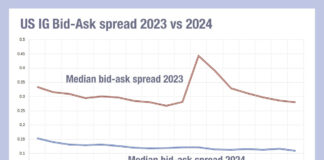

A great vintage for bid-ask spreads

This year’s bid-ask spreads in US investment grade are half those of last year, prompting much celebration on the buy side, but clearly having...

TradeTech 2023: Fixed income increases share of ETF world

Fixed income is becoming a larger part of the exchange traded funds (ETFs) universe as investors and traders seek greater flexibility and liquidity, according...

Market structure: The alternatives in market making

The DESK profiles five of the major electronic liquidity providers.

Given the strains on market making in fixed income, it is vital that buy-side desks...

Is the market braced for another sell-off?

Traders are reporting the positive effects of innovation upon market liquidity but central banks hold all the cards.

The association between the Covid 19 pandemic...

FILS 2021: Next steps to automating the bond market

Data analysis, interoperability and flexibility are the top priorities for automating the bond markets, delegates at the 2021 Fixed Income Leaders Summit (FILS) in...

Innovation through electronic trading

Dan Philip, Institutional Sales & Trading at Jane Street speaks to The DESK.

How has the bond market changed this past year, in the aftermath...

Meet the new market makers

The DESK profiles six of the major electronic liquidity providers.

Non-traditional market makers were seen to offer liquidity when many dealers pulled back in 2020....

Subscriber