Tag: JP Morgan

TransFICC: The Evolution of the Muni Market

Driven by volume growth and technology

By Bo-yun Liu, Director of Product Solutions, TransFICC

Taken in aggregate, the Muni market is roughly $4.2T Outstanding with $15.6B...

JP Morgan taps Tradeweb for automated EGB basis trade

JP Morgan has selected Tradeweb for the execution of its first fully-automated European government bond (EGB) basis request-for-quote (RFQ) transaction.

Tradeweb’s platform allows for in-competition...

JP Morgan exec appointed in Broadridge hiring spree

Munish Gautam has joined Broadridge’s Trading & Connectivity Solutions (BTCS) business as global head of trading platforms product management.

Based in London, Gautam reports to...

Buckley swaps MarketAxess for JP Morgan

Mark Buckley has joined JP Morgan as vice president of e-credit sales, based in London.

JP Morgan reported US$5.7 billion in fixed income trading revenues...

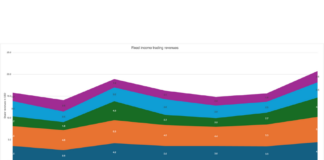

FICC revenues climb as US banks capitalise on volatility

Wall Street banks posted US$18.8 billion in fixed-income trading revenues in Q2, driven by their activity in macro products, particularly rates and currencies. JP...

Optimising execution in Qatari and Kuwaiti bond sell-off

Buy-side traders need to carefully manage order execution when a bond market moves into or out of an index, as the large directional moves...

The pretenders, and kingmakers, to the bond throne

Dealers are backing several new trading platforms who are fighting major incumbents for market share.

In the bond market, the trading platform landscape has been...

JP Morgan leads Q1 trading results, Dimon calls for deregulation

JP Morgan raced ahead of competitors in fixed income trading revenues over the first three months of 2025, reporting over US$1 billion more than...

Electric dreams in global rates markets

Electronic trading between dealers and buy-side institutions is taking different paths in government bond markets, globally. Lucy Carter investigates.

“We have seen growth in the electronification of...

The Book: JP Morgan rules the roost in Q1 DCM market...

JP Morgan has retained its top spot in global debt capital markets rankings by volume for Q1 2025, according to Dealogic.

With US$178.5 billion, 806...