Tag: MarketAxess

Chowdhury promoted at MarketAxess

Riad Chowdhury has been promoted to head of EMEA and APAC sales at MarketAxess.

Based in Singapore, he will retain his existing responsibilities as head...

How e-trading won bond investors an opportunity in the Venezuelan crisis

The dramatic escalation of Venezuela’s political crisis — culminating in the US military operation that removed Nicolás Maduro from power — has triggered a...

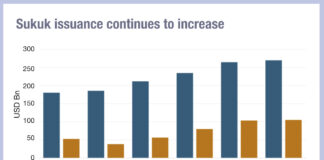

S&P Global: Record sukuk issuance in 2025

S&P Global has reported that global sukuk issuance hit US$264.8 billion in 2025, up from $234.9 billion in 2024, driven by solid economic growth...

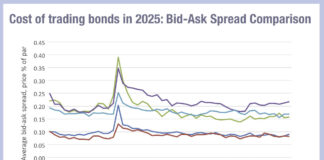

Visualising the cost of credit trading cut in half since 2023

Credit markets have seen bid-ask spreads, a proxy for trading costs for the buy-side, tighten further in the first two weeks of 2026, relative...

MarketAxess EM volumes top US$1tn YTD

MarketAxess has reported more than US$1 trillion in emerging markets (EM) trading volumes year-to-date.

Average daily volumes reached approximately US$5 billion between January and November,...

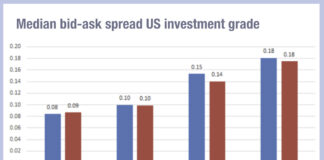

Bid-ask spread volatility highest in US bond markets

When comparing liquidity across markets in 2025, buy-side bond traders may consider European investment grade markets to have an optimal set of characteristics. However,...

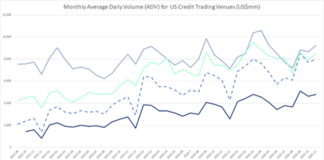

Tradeweb and MarketAxess beat TRACE growth in November

US electronic credit activity firmed in November. On FINRA’s TRACE tape, combined US investment-grade and high-yield average daily volume (ADV) rose to US$57.8 billion,...

Electronic bond trading expanding to match MENA markets rapid growth

Bond markets in the Middle East & North Africa (MENA) region have seen primary and secondary activity surging in 2025, reflecting individual country’s sovereign...

IG issuance across US and Europe up 20% on five-year average

US investment grade debt issuance has hit $1.7 trillion year to date (YTD) in 2025, a 12% increase year on year (YoY). That brings...

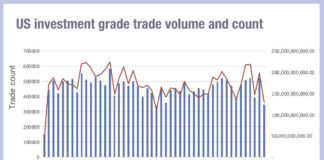

US credit activity dropped off a cliff in late November

Analysis of US corporate bond market activity has found that trading volumes and counts plummeted going into the final month of the year. A...