Tag: MarketAxess

MarketAxess acquires RFQ-hub

MarketAxess has acquired a 90% controlling stake of global derivatives and ETF platform RFQ-hub.

RFQ-hub operates a bilateral, multi-asset and multi-dealer request for quote (RFQ)...

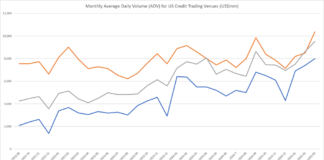

MarketAxess holds US credit trading high ground in April volatility

A burst of spread widening and credit ETF related trading pushed US electronic credit trading to another record in April.

TRACE volumes for investment grade...

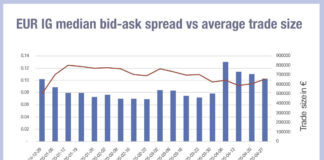

European bid-ask credit spreads not assuaged by tariff roll back

Liquidity costs in European corporate bond trading remain elevated, after the tariff shock in early April saw bid-ask spreads widen significantly across markets, according...

TS Imagine’s Spencer Lee joins MarketAxess

MarketAxess has appointed Spencer Lee as head of client product for the Americas, effective 12 May.

In the San Francisco-based role, Lee will cover business...

E-trading hesitation in European corporate bonds

Electronic trading infrastructure is growing in the European corporate bond market, but e-trading rates have stayed static from 2023 onwards, according to a recent...

Excited or scared? The liquidity rollercoaster

Bid-ask spreads across all credit markets shot up in the week of 7 April, following the announcement of global tariffs on imports to the...

Biscardi joins MarketAxess

Experienced bond trader Tom Biscardi has been appointed senior open trading specialist at MarketAxess.

The trading platform reported US$42.9 billion in total average daily volume...

Trading Intentions Survey 2025

The battle for pre-trade analytics

The 2025 Trading Intentions Survey canvassed 40 buy-side trading desks across asset managers headquartered in Europe (52%) and the US...

Subscriber

Surge of activity on fixed income trading platforms

MarketAxess has regained the lead in US credit fully electronic trading amid a surge of activity in March with Trace printing a record US$61.2...

Pre-Trade data strategy: Optimizing protocol selection in European Credit

By Chris Egan & Aria Pattinson-Spiers: A decision that clients often face is which trading route to take—a high touch or low touch approach....