Tag: Neptune Networks

The evolving landscape of fixed income market data

Byron Cooper-Fogarty, CEO, Neptune Networks

The fixed income market continues to evolve at a pace I’ve not previously experienced in my 30 years in the...

Overbond integrates Neptune Networks axe data

Overbond, an AI-driven fixed income analytics and trade workflow automation provider, has integrated Neptune Networks’ axe data to help buy-side traders more efficiently discover...

Byron Cooper-Fogarty named CEO of Neptune Networks

Byron Cooper-Fogarty will become CEO Neptune Networks, the fixed income network for disseminating real-time axe data, and on 1 April 2024 with John Robinson...

Lombard Odier taps Neptune Networks for real-time axe data

Geneva-based Bank Lombard Odier has partnered with fixed income network Neptune Networks to offer its traders and advisers real-time axe data.

Lombard Odier clients can...

Derivatives: Credit default swaps – The revival

Applying innovation from corporate bond markets to credit derivatives trading could boost liquidity at a point of market stress.

Single-name credit default swaps (CDSs) provide...

Trading Intentions 2023 Profile: Neptune

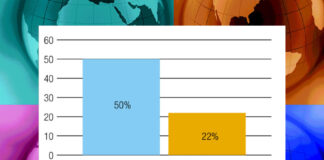

Neptune proves the standalone choice

Neptune is the most used standalone pre-trade data source in credit markets, with half of desks employing its streaming axe...

FILS USA 2022: Can traders get a single view of a...

Scaling up the ability of the trading desk to process orders – either by size of the orders, or the number of tickets the...

Flow Traders joins Neptune as first non-bank sell-side participant in Europe

Flow Traders will become the first non-bank sell-side participant in Europe on Neptune Networks, the fixed income platform for disseminating real-time axe data.

Byron Cooper-Fogarty,...

State of the market: Analysis of the platform landscape

Consolidation of the market continues, yet there are clear areas of growth in 2020.

In the corporate and government bond trading space for dealer-to-client trading, the...

Interview : Grant Wilson & Byron Cooper-Fogarty : Neptune Networks

Neptune’s new approach to supporting execution

Since launching in 2016 Neptune has grown significantly, enabling dealer to client exchange of axes between bond traders, and...