Neptune proves the standalone choice

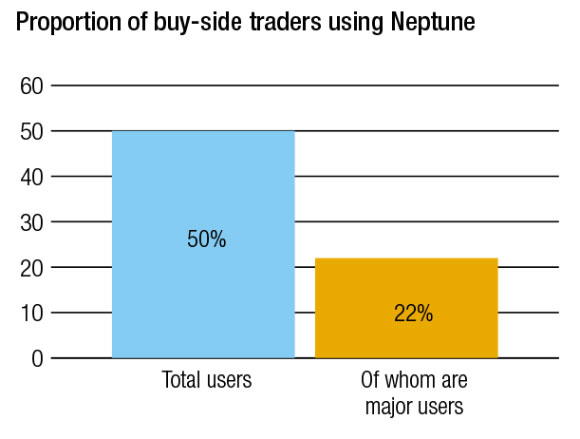

Neptune is the most used standalone pre-trade data source in credit markets, with half of desks employing its streaming axe services, and 22% of traders ranking themselves as ‘major users’, giving it the highest proportion of major users amongst its client base of any commercial data offering.

The firm’s success is in part due to its collaboration with dealers in sourcing data, supported by its status as a bank-owned platform, but also in its client focus for buy-side firms as its seeks to find better ways to deliver information in a timely manner.

The firm’s success is in part due to its collaboration with dealers in sourcing data, supported by its status as a bank-owned platform, but also in its client focus for buy-side firms as its seeks to find better ways to deliver information in a timely manner.

“On the credit side we’ve become a mature platform, but a big growth area for us this year has been adding algo axes from the major dealers,” says Byron Cooper-Fogarty, chief operating officer at Neptune. “That’s been a big driver of growth, and certainly an area that buy-side clients want to see more data.”

It is also ranked most highly effective at finding liquidity out of all standalone pre-trade data sources for credit, in the Trading Intentions Survey. Outside of the traditional corporate bond markets in the US and North America, Neptune has found demand for services that reach across different instruments and geographies.

“In emerging markets, notably Asia, we’re doing a lot more in the region, focused on Asian credit denominated in dollars, while Euro government bond (EGB) activity has also increased significantly,” he says. “In the US we’re moving into muni bonds, and have plans to expand into single name credit defaults swaps as well.”

“In emerging markets, notably Asia, we’re doing a lot more in the region, focused on Asian credit denominated in dollars, while Euro government bond (EGB) activity has also increased significantly,” he says. “In the US we’re moving into muni bonds, and have plans to expand into single name credit defaults swaps as well.”

Its data is consumed not only by traders but also by portfolio managers and other capital markets teams in risk and investment functions. That has led to an increase in direct feeds of prices into trading and analytics tools, along with the firm’s own graphical user interface (GUI).

“The thing we’re getting asked most at the moment is the ability to analyse portfolio trades, pre-trade, based on the axe data, because that gives people a more complete picture of who they should be going to on PTs. More algos are linked to that trading approach, which leads to better execution.”

©Markets Media Europe 2023

©Markets Media Europe 2025